Crypto mining generates heightened interest from companies and individuals

Crypto mining is the process of adding verified transactions to the blockchain. It is also a means of releasing a new cryptocurrency. The mining aspect involves compiling the recent transactions into blocks and solving complex mathematical problems. Miners who solve the problems first are rewarded in the form of cryptocurrencies like bitcoin, Ethereum or any cryptocurrency, depending on what the user is mining.

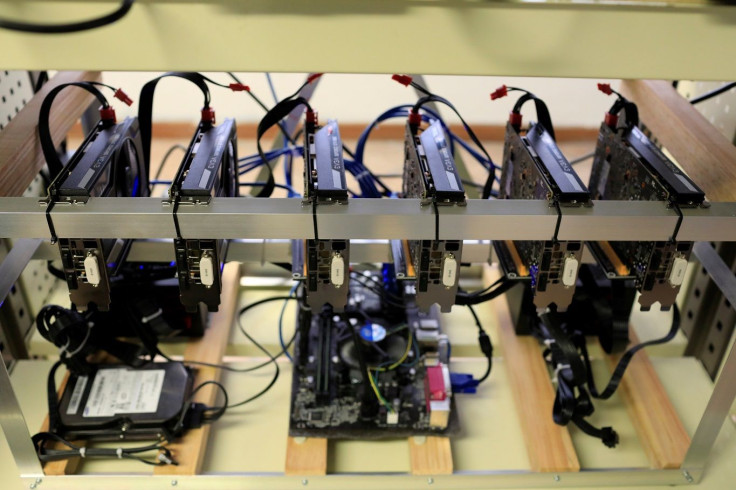

Mining crypto coins involves computers and programs, but others use dedicated rigs. While the impression is that anyone can get into cryptocurrency, to successfully profit through mining is largely influenced by the quality and quantity of the computers the miner uses.

Take for instance Business Insider reporter Antonio Villas-Boas, who recently got into crypto mining. He started to make money through the process but only after he bought a few top-of-the-line and expensive graphics cards for his mining rig. Villas-Boas said in February that he was still eight months away from breaking even.

The growth of cryptocurrencies and the sum of investment needed to make crypto mining a lucrative and big operation have given companies from various industries a reason to look toward mining coins.

Companies enter crypto coin mining

Many established companies that come with a bigger budget now allot a part of their funds to invest in cryptocurrency mining. Imaging tech company Kodak recently introduced a US$3,400 (AU$4,400) crypto mining machine called KashMiner, said to produce US$375 (AU$487) worth of bitcoin every month. From a bigger perspective, it could generate a revenue of US$9,000 (AU$11,700) in two years. After purchasing the KashMiner, Kodak’s stock tripled in a week, as investors saw a strong potential for growth now that Kodak is a producer of bitcoin.

Two other non-crypto companies joining the bandwagon are Mansfield-Martin Exploration Mining, Inc. (TCMKTS: MCPI) and PotNetwork Holding, Inc. (OTCMKTS:POTN). These two companies are leaders in traditional mining and cannabis industry, respectively. Venturing into crypto mining in their own ways is another way of growing their finances and at the same time embracing the crypto advancements today.

Mansfield-Martin Exploration Mining, Inc. recently revealed a new altcoin called Silverback.IO in partnership with Qu Ltd. New altcoins and initial coin offerings (ICOs) are not a smart investment as many as these coins are prone to becoming obsolete if the developers don’t have the proper know-how of blockchain.

It seems, however, that the mining company has a great strategy planned out. It uses silver as a price basis for Silverback.IO, but that’s not all. To give the new altcoin more traction in the competitive crypto market, Silverback.IO is going to be backed by Ethereum, the current leader in altcoins.

On the other hand, PotNetwork is taking baby steps into the crypto market with the introduction of a new subsidiary called Blockchain Crypto Technology Corp. Through this, the Diamond CBD owner is looking to diversify its assets and investment options by adding crypto into the mix. The company is already making tremendous achievements in the CBD industry and its foray into crypto is going to be promising as well.

These companies are slowly adopting blockchain and cryptos into their business foundations in the hopes of giving themselves and their investors a ton of opportunities for big returns.

Article via press release sent for consideration to publish.