Apple posts $26b Q1 income; iPhone, Mac sales down

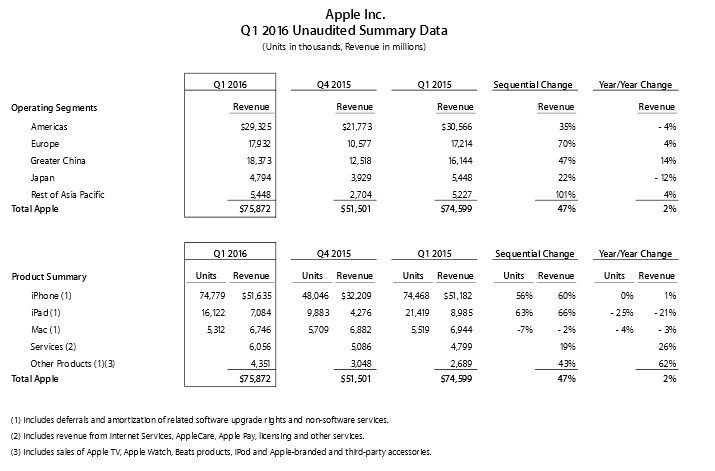

Apple (NASDAQ: AAPL) posted a revenue of US$75.9 billion (AU$107.9 billion) for the first quarter ending Dec. 26, 2015. It recorded a quarterly income of US$18.4 billion (AU$26.2 billion), or US$3.28 (AU$4.66) diluted share.

In its financial report released Wednesday, Apple boasted it generated operating cash flow of US$27.5 billion (AU$39.1 billion) during the quarter, returning over US$9 billion (AU$12.8 billion) to investors through share repurchases and dividends.

The company generated revenue of US$74.6 billion (AU$106.1 billion) for the same quarter last year, which means it saw about 2 percent uptick for Q1 2016.

“We have now completed US$153 billion (AU$217 billion) of our US$200 billion (AU$284 billion) capital return program,” CFO Luca Maestri said.

“Our team delivered Apple’s biggest quarter ever, thanks to the world’s most innovative products and all-time record sales of iPhone, Apple Watch and Apple TV,” CEO Tim Cook said in a statement. “The growth of our Services business accelerated during the quarter to produce record results, and our installed base recently crossed a major milestone of one billion active devices.”

However, the sales of its star products were weaker than expected. IPhone sold 75.8 million units, down from 74.5 million sold a year ago. IPad recorded 16.1 million sales against 21.4 million units from last year. Mac also went down from 5.5 million units a year ago to 5.3 million units. The company was able to win with sales from its services and other products, though.

Apple also released guidance for its Q2 2016 results, predicting revenue between US$50 billion and US$53 billion (AU$72 billion and AU$75.3 billion), and gross margin between 39 and 39.5 percent for Q2 2016.

Meanwhile, the company made almost $8 billion in Australia but only paid $85 million in tax in 2015, according to accounts filed with the Australian Securities and Investments Commission. The revelation follows a Senate inquiry into corporate tax avoidance by multinational companies.

According to the figures, filed before Australia Day and obtained by Fairfax Media, Apple recorded higher sales, marketing and distribution expenses of $435 million and administrative expenses of $30.7 million. Its after tax profit was $123 million, a dip from the previous year’s $171.5 million. It paid $80.3 million tax in 2014 from its $7.9 billion revenue.

Apple is under audit by the Australian Taxation Office for alleged tax avoidance. The Cupertino, California-based company, along with Goole and Microsoft, is accused of low level of taxes paid in Australia.

“Apple Australia pays all taxes it owes in accordance with the Australian law,” a rep from the company insisted to Fairfax Media.