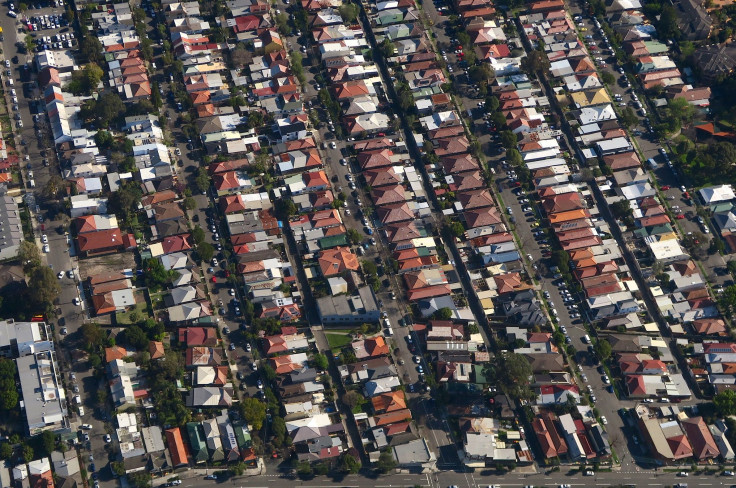

Australia suburb mortgage interest costs 7.9%, almost double capital city's average

HashChing has revealed that borrowers from the suburbs of major capital cities were paying almost double than the capital cities' average. According to data analysed by an online mortgage marketplace, most borrowers would pay up to 7.9 percent for their mortgages.

The data analysed more than 1,000 mortgage applicants between December and January. The suburbs with mortgages that cost up to 7.9 percent were the Sydney suburbs including The Ponds, Quakers Hill, Campbelltown, Doonside and Stanhope Gardens. The average Sydney central business district (CBD) mortgage is 4.5 percent.

Melbourne suburb homeowners were paying up to 7 percent while the average interest rate in the city was 4.5 percent. The suburbs include South Morang, Mernda, Blackburn, Glen Waverley, Narre Warren and Cranbourne. On the other hand, Queensland suburb homeowners were paying up to 7.4 percent for suburbs including Labrador, Surfers Paradise, Brendale, Coomera, Advancetown, Austinville and Springbrook. The mortgage in the city's capital is 4.7 percent.

HashChing CEO Mandeep Sodhi said that the suburbs have a large population of self-employed borrowers. Based on data gathered by the HashChing platform, 87 percent of the borrowers were self-employed. Sixty-two percent of the self-employed borrowers have investment properties in the suburb. Banks perceived self-employed to have unstable income, making them a risk on the part of the banks.

According to Hashching blog, low doc loans can help self-employed borrowers to get a home loan by presenting available proofs of income. They just need to complete documents such as business activity statements, valid ABN and a duly filled out income declaration form. They also need to pay at least 10 percent of the purchase price as a deposit.

“It’s not a bad thing to be self-employed ... If you are making your repayments on time, it is time for you to look for a better deal and a better bank. [The banks] are becoming more accepting of it,” Sodhi told News.com.au. Sodhi said that many self-employed borrowers were paying more than seven percent of the interest as they thought it was the best rate they could get.

“Sticking to the same home loan provider out of some misguided sense of loyalty is costing borrowers tens — or even hundreds — of thousands of dollars over the life of their home loan,” Sodhi said. They were also loyal to their banks. However, the banks were not telling them about new or lower rates that could help them save as much as $87,400 over the life of their loan. This was based on a one percent saving on a $500,00 loan under a 25-year term.