Australian Stock Market Report –Afternoon December 16, 2014

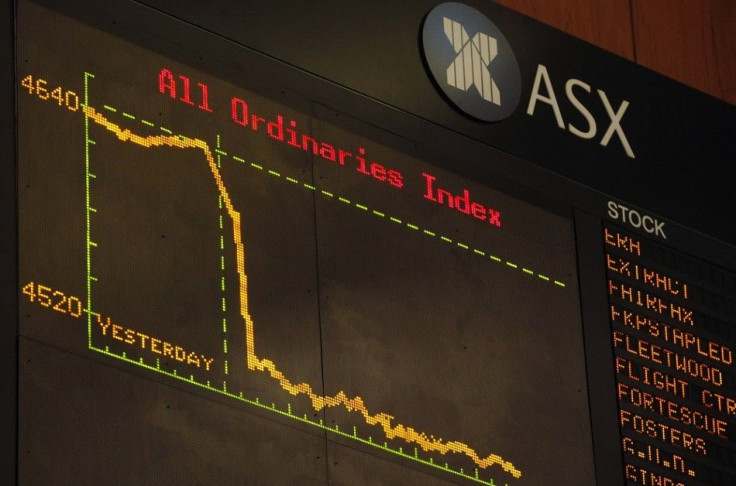

Losses worsened this afternoon with Australian shares falling by 0.7 per cent and closing at a fresh two-month lows in the process. The ASX 200 Index lost 0.7 per cent with both mining and energy industries slumping by around 2 per cent.

Energy stocks were the hardest hit today, slumping by 2.1 per cent. Oil and gas company Woodside Petroleum (WPL) fell by 2.6 per cent while Santos (STO) slumped by 2.5 per cent. The price of oil has now fallen by 12 per cent this month and 13 per cent in November. The weakness was triggered by OPEC's decision a fortnight ago to maintain production quotas.

Treasury Wine Estates (TWE) fell by 4.5 per cent after its Annual General Meeting today. TWE said it may retire some of its 'non-priority Commercial brands' at some point.

Crown $CWN fell by 1.3 per cent and has announced a Joint Venture (JV) with corporate bookmaker, BetEasy. 67 per cent of the JV will be owned by Crown and 33 per cent by BetEasy.

Telstra (TLS) failed to maintain early gains and ended 0.3 per cent softer. Australia's largest telco is expected to transfer ownership of its copper assets to NBN Co.

Volume picked up this afternoon with 1.4bn shares traded worth $4.9bn. 346 stocks are up, 527 are down and 366 are unchanged.

The Reserve Bank's Board minutes were released earlier in the day and were largely as expected today. The central bank continues to believe "that the most prudent course was likely to be a period of stability in interest rates". The RBA would like to see the Australian dollar fall further from here to around US$0.75. Our currency has already fallen by around US10c over the past three months against the greenback. This has been a positive considering commodity prices have slumped this year. Iron ore prices have halved since 1 January.

The Roy-Morgan Weekly Consumer Sentiment index fell by 0.2 per cent last week with confidence now at a four-month low. Retail stocks like Myer, Harvey Norman and JB Hi-Fi all underperformed the broader market.

Tonight manufacturing updates in both Europe and the US will be key. Bank stress test results for eight UK banks will be released at around 6pm AEDT while Europe's trade balance will be issued at 9pm AEDT.

[Kick off your trading day with our newsletter]

More from IBT Markets:

Follow us on Facebook

Follow us on Twitter

Subscribe to get this delivered to your inbox daily