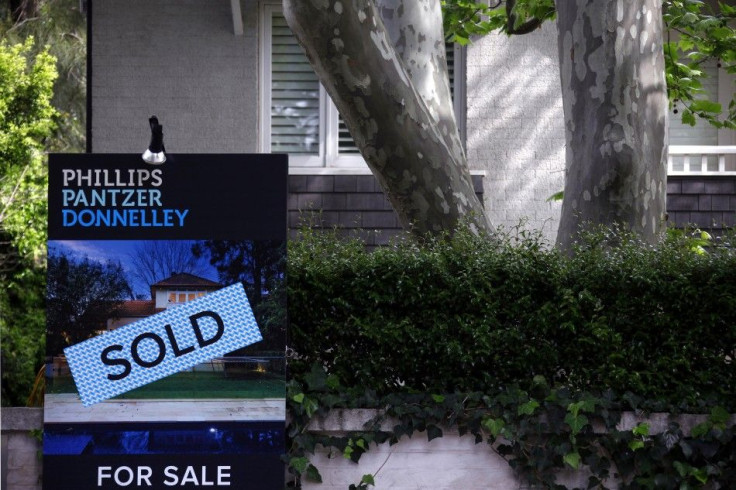

Australia's Property Sector Grows Bigger Than Mining Industry

The property industry in Australia has grown larger than mining, financial services or home ownership. The industry has since doubled its contribution to the country’s gross domestic product in the last decade.

According to research commissioned for the Property Council of Australia, the property industry contributed $182.5 billion or 11.5 percent of GDP to the Australian economy in the last financial year. Home ownership had a value of $147.1 billion while the mining industry had $140.9 billion.

The Property Council wants to use the property industry, which employs about 1.1 million people. The industry is the second biggest employer after social assistance and healthcare. The group is prepared to lobby for reforms to promote growth, reports the Australian Financial Review.

“If we can unlock the potential to increase the property’s contribution even further, that will mean more jobs and more prosperity for Australians,” said Ken Morrison, chief executive of the Property Council. He added that governments can make it happen by abolishing taxes like stamp duty and make planning processes more efficient to make houses more affordable for Australians.

The report said about $279.7 billion worth of activity from the property industry has contributed to the flow of goods and services. The flow-on activity led to 1.54 million jobs. The property industry has paid $72.1 billion tax revenues and local government rates and fees. The amount is more than twice the amount of tax compared with the average of the Organisation for Economic Cooperation and Development.

Morrison said Australia’s economy needs the property industry to do well as the country moves away from the mining investment boom. New South Wales contributed the highest amount of tax with $23 billion followed by Victoria with $16 billion, Queensland with $13 billion and Western Australia with $10 billion.

Meanwhile, more than a quarter of Australia’s 200 richest people earn most of their money in the property industry, reports news.com.au. Many of the wealthy also invest their funds in property development or management businesses. BRW Rich List editor John Stehnsholt said all eyes would be in the property industry in the coming months. He believes the Australian property boom does not show any sign of “abating.”

(To report problems or leave feedback on this article, contact: r.su@ibtimes.com.au)