Business confidence across Australia down, but outlook to change with new leadership

A survey of small and medium business confidence in Australia while the Abbott government was still in power showed a four point fall nationally, but an Australian business association says Small to Medium Enterprises (SMEs) are more positive following September’s change in Prime Minister.

The Sensis Business Index, conducted in August before the leadership change but only recently released, showed 23 percent of SMEs surveyed felt worried about the future due to decreasing sales, unfavourable trade, and the economic or industry environment.

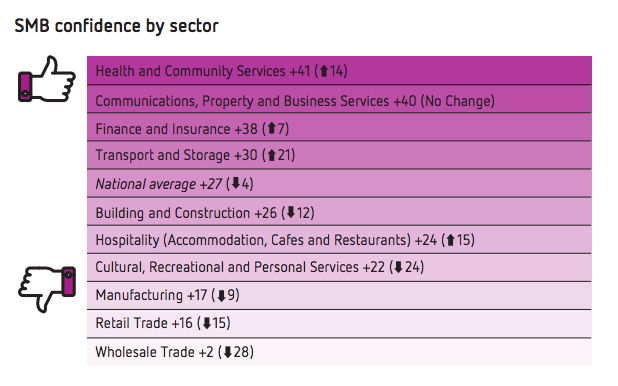

The study of 1,000 businesses showed confidence was highest in the health and community services sector at +41 points, while wholesale trade experienced the greatest drop in confidence at 2+ points.

However Craig West, executive director of the SME Association of Australia, says sentiments have changed since Prime Minister Malcolm Turnbull replaced former leader Tony Abbott.

“I can’t find too many businesses that are struggling or aren’t doing well.” he said. “None of them are complaining, none of them are whinging, it’s not doom and gloom.”

Recent rhetoric from the government to SMEs has contributed to the boost in confidence following the leadership change, said West.

“I think industries where innovation is important - science, fintech and biomedical - are definitely more upbeat than a month ago. They’re back on the agenda,” he said. “Our economy is not about digging things out of the ground and selling it any more.”

According to the Sensis report, overall confidence declined in all locations except NSW, the ACT and Queensland. The ACT had the highest confidence level (+47 net).

SME owners in NSW were the most optimistic in the quarter ending July 2015, with 22 percent perceiving growth in the economy, the highest of any state or territory.

In addition to boosts from infrastructure projects in NSW, some sectors have benefited from “a short term ‘caffeine hit’” due to activity within the real estate industry, said enterprise mentor and trainer Daniel Boland from consultancy SeeGreen Communications.

“The positive outlook in NSW [which] can be directly related to the injection of Chinese cash into the Sydney property market fuelled windfall gains for the sellers. Thus the local economy across the ‘cash’ spending in retail, hospitality and tourism sectors get the benefit. Only Sydney and Melbourne are getting the property investment price rises, not other states as yet.”

Businesses from South Australia and Western Australia recorded the most pessimistic outlook for the current economy, with 45 percent and 44 percent of SME owners respectively from these states reporting the economy was slowing.

Western Australia’s dependence on mining and Chinese steel makers could explain lower business confidence in the region, said Boland.

“After 25 years without a downturn, the Australian economy cannot be sustained with positive confidence without a total small business policy rethink.”