Chinese investment in Australia rises but lags behind US

Chinese investment in Australia rises to $15.4 billion in 2016, its peak since the global financial crisis (GFC). A new report indicates that Chinese and Australian companies signed 103 deals last year, which resulted to a 12 percent rise in investments from 2015.

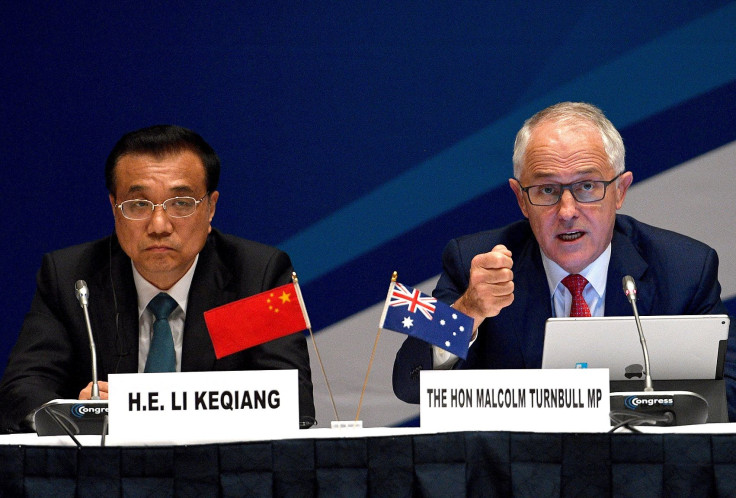

Aussie Prime Minister Malcolm Turnbull's government blocked two major purchases by Chinese companies last year due to national security. But a report from Sydney University and accounting firm KPMG called “Demystifying Chinese Investment in Australia” stressed that the vast majority of deals pushed through.

The report further indicates that there are signs of an increasing maturity by Chinese businesses in the Australian market. One of these is the mounting number of joint ventures with more repeat investments by established Chinese businesses. The number of Chinese visiting Australia also rose by 22 percent to 1.1 million in the 12 months to September 2016 according to Tourism Research Australia.

Despite the surge, the report warned that the Down Under risked missing out on the Chinese investment boom in the future. Investors from China are reportedly looking to secure more deals with the United States and Europe.

University of Sydney Business School’s Hans Hendrischke, who co-wrote the study, recognised that Australia managed to prove itself as a preferred destination for Chinese capital. However, he urged Australians to be mindful that the growth in investment is slowing compared to other countries such as the US.

Australia has secured its spot as the second biggest recipient of Chinese investment in the world. The US currently tops the list.

Hendrischke said infrastructure projects, commercial real estate and health care drew the most investment. "Australia is providing major goods for Chinese consumers that are agricultural goods, that is services, so Australia is part of a new orientation of the Chinese economy," he told the ABC's RN Breakfast program.

KPMG Australia's head of Asia and International Markets Doug Ferguson said Chinese investment in the country’s agribusiness sector was driven by the increasing demand for premium quality food while China's middle-class population continues to grow. “The increase in Chinese investment also reflected the greater competitiveness of Australian produce in China following the China Australia Free Trade Agreement,” SBS has quoted him saying. Moon Lake's acquirement of Tasmanian dairy giant Van Dieman's Land and the joint-venture acquisition of the S Kidman & Co cattle empire by Hancock Prospecting and Shanghai CRED Real Estate are some major agribusiness deals.

TRT World/YouTube

Read more: Australia 2017 budget: Government reportedly slashes university funding

Auction clearance rates in Sydney and Melbourne’s housing markets soar