Global Markets Overview – 4/16/14

Global equities were mixed with US markets continuing their recovery, while European and emerging markets struggled. US markets struggled early as China growth fears and Ukraine concerns weighed on equities, but they managed to reverse on earnings optimism. Earnings from Johnson & Johnson and Coca Cola impressed, while Intel came in mildly better than expected.

In Europe it was one-way traffic, with the latest being Ukraine troops looking to regain control of facilities occupied by pro-Russian militants. A raft of economic releases from China set the tone for risk in Asia yesterday, and I sense caution will prevail as we look ahead to today's GDP release. With China's money supply growth slowing significantly along with a 19% drop on aggregate financing levels, investors are quite nervous about today's Q1 GDP print. There have been plenty of reports highlighting the risk of China growth falling short. Today's GDP reading, due out at 12pm AEST is expected to show 7.3% growth, while industrial production is anticipated to be up 9% on-year.

We also have fixed asset investment and retail sales data due out; should this data miss expectations tomorrow, this could well be the trigger for some stimulus. As a result, interpretation of the data will be key for today's trade. AUD/USD is back below 0.94 and will be one of the key pairs to watch when China releases its GDP numbers.

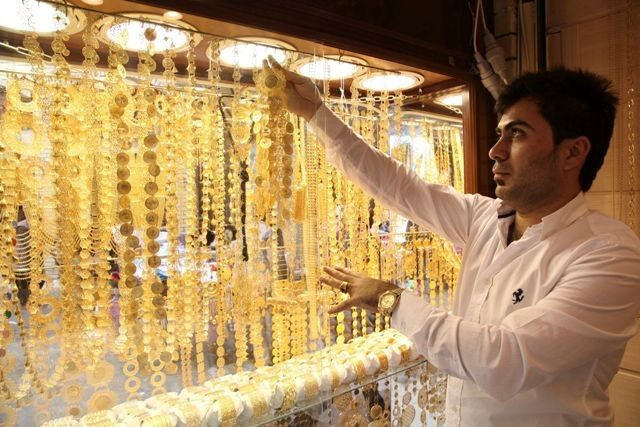

Gold falls sharply

The major FX pairs were relatively calm with limited moves, particularly despite a raft of data releases in Europe and the US. Data in Europe generally disappointed, while the US continued to post some encouraging readings. This resulted in mild USD strength with treasuries also firmer. Perhaps this contributed to the sharp drop in gold which briefly ventured below 1300/oz for the first time in over a week. Given the Ukraine situation seems to be escalating again, some traders might be looking to take advantage of the dip.

Resource reports in focus

Ahead of the open we are calling the ASX 200 up 0.2% at 5,397. The Australian market did well to hold on to its gains yesterday considering the carnage in Chinese equities. We are likely to see relatively flat to mixed trading ahead of the China data. This will be the key event for Asian trade and will set the tone for the rest of the session. All things considered, the GDP estimate seems quite conservative and this could actually put a slight upside risk to the data.

Resource names are in for a tough start after commodities struggled in London. BHP's ADR is pointing 1% lower to 37.42, while RIO might also give up yesterday's modest gain. Focus will be on BHP's 3Q output report with reports surfacing that the mining giant may bid for Potash Corp again. Fortescue also has its 3Q output report today with focus being on FY guidance and the iron ore production run rate. Also reporting will be Mount Gibson and Iluka Resources. Following its results yesterday, OZ Minerals has been downgraded to sell (from neutral) by UBS.

[Kick off your trading day with our newsletter]

More from IBT Markets:

Follow us on Facebook

Follow us on Twitter

Subscribe to get this delivered to your inbox daily