HILDA Survey reveals striking gender and age divide in financial literacy. Test yourself with this quiz

The Household, Income and Labour Dynamics in Australia (HILDA) Survey tells the stories of the same group of Australians over the course of their lives. Starting in 2001, the survey now tracks more than 17,500 people in 9,500 households.

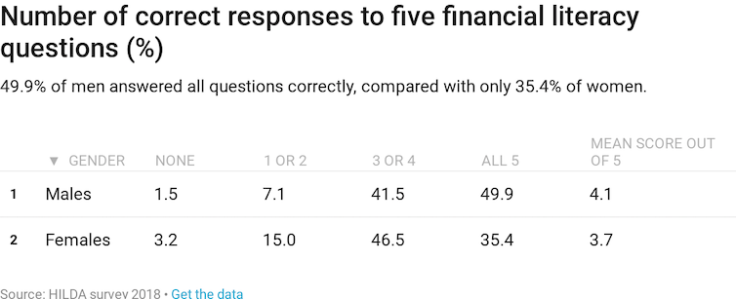

One of the most striking findings from this year’s HILDA report is the large gender divide in financial literacy. Women exhibit much lower levels of financial literacy than men.

The OECD International Network on Financial Education defines financial literacy as:

a combination of awareness, knowledge, skill, attitude and behaviour necessary to make sound financial decisions and ultimately achieve financial wellbeing.

A series of questions assessing basic competencies in financial concepts such as inflation, portfolio diversification and risk versus return, developed by Annamaria Lusardi and Olivia Mitchell, was put to the 17,500 HILDA respondents in 2016.

We found that, across Australia as a whole, about 50% of men correctly answered all questions, compared with only about 35% of women.

In a world in which women are as engaged in the modern economy as men, it is not clear why this is the case. But it very much matters.

The report shows that low financial literacy is associated with poor financial well-being. For example, the poverty rate among people with low financial literacy is over twice the poverty rate among people with high financial literacy.

Women are indeed over-represented in poverty statistics and other measures of socioeconomic disadvantage. Low financial literacy cannot be ruled out as a factor in these outcomes.

This is further reinforced by the finding that women do not, on average, rate themselves lower than men on their personal financial management capability.

They are therefore unlikely to compensate for their lower financial literacy by, for example, seeking expert advice.

Some of the other findings from this year’s HILDA report are covered in this short video:

Age matters too

While the gender divide is the most striking finding, substantial differences across age groups are also found. The young – aged under 25 – are the least financially literate, while those approaching retirement – aged 55 to 64 – are the most financially literate.

Young people scored particularly poorly on the question assessing understanding of inflation. The low-inflation environment that has persisted in Australia for some time now may have contributed to this. Young people simply have not experienced much inflation in their lifetimes.

Financial literacy is also strongly associated with household income and household wealth. Saliency no doubt plays a role in financial literacy: people with very little money are unlikely to take much interest in financial concepts such as diversification and the risk-return trade-off. Unfortunately, this is likely to help perpetuate their low financial well-being.

Financial literacy affects attitudes to finances

Financial literacy is strongly connected to our attitudes to financial matters, in ways that give insights into why financial well-being might be lower for those with lower literacy.

Perhaps most important in this regard is that willingness to take financial risks is very low for the least financially literate. In contrast, it’s quite high for the most financially literate.

For example, 73% of those with low literacy report not being prepared to take any risks, compared with only 36% of those with high literacy.

Saving and spending horizons also tend to increase as financial literacy increases.

Of the least literate, 55% report that the next week or the next few months is the most important time-frame in planning saving and spending. By contrast, over two-thirds of those with high financial literacy report that the most important period in planning saving and spending is the next year, or longer.

Consistent with this finding, measures of “motivation traits” show that financial literacy is positively associated with “future orientation” – the extent to which one thinks about the long term when making decisions.

Financial literacy is also associated with lower impulsiveness and a greater desire to achieve things in life.

Financial behaviours

Differences in financial literacy do translate into differences in financial behaviours.

Perhaps unsurprising is that people with low financial literacy are less likely to get involved in decisions about household finances. This may be a rational response to the knowledge that one has low financial literacy, or it could reflect a lack of interest in (or perhaps even exclusion from) financial matters. This in turn might lead to both low participation in household decisions and low financial literacy.

More concerning is that low financial literacy is associated with a lower propensity to save regularly and, relatedly, a greater likelihood of experiencing financial stress, such as an inability to pay the rent or mortgage on time, or having to sell or pawn something of value.

The decision to hold a credit card is also a very large point of difference between low-literacy and high-literacy people. Three-quarters of people with low levels of financial literacy do not have a credit card, compared with 30% of those with high financial literacy.

That said, this is possibly not a bad thing. That’s because those with low financial literacy who do have credit cards are considerably less likely to pay off the outstanding balance each month than the financially literate.

Overall, these findings suggest much more work remains to be done to improve financial literacy in Australia – across genders, generations and income groups.

To hear Roger Wilkins, Deputy Director (Research) of the HILDA Survey, explain the latest HILDA findings in an interview, listen to the latest episode of our podcast Trust Me, I’m An Expert over here.

Roger Wilkins, Professorial Research Fellow and Deputy Director (Research), HILDA Survey, Melbourne Institute of Applied Economic and Social Research, University of Melbourne

This article was originally published on The Conversation. Read the original article.