Investing in innovative technology to solve demand for naturally-grown shrimp products

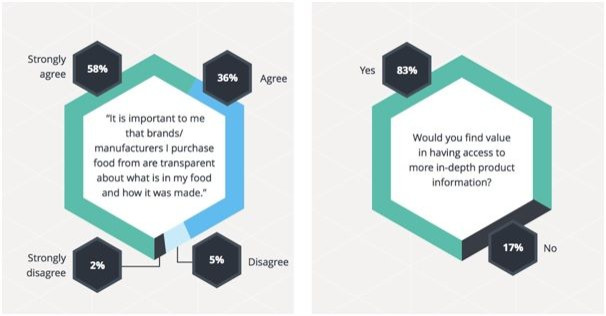

Transparency in food labels is set to emerge as one of the most significant food trends next year, as consumers become more conscientious about food safety. In the United States, trust is the primary factor that influences customers to buy products and motivates companies to be more straightforward with their packaging.

In a 2016 study made by Label Insight, knowing where the food was sourced and how it was prepared is now part of people’s decision-making when it comes to purchasing what to eat.

Due to recent widespread scandals about food preparation, the call for natural, ethical and sustainable food has increased. For instance, Yorgo’s Foods Inc. and True North Seafood were recently involved in a massive recall of their respective products — the Greek-style food brands and Toppers Smoked Salmon Flakes — because of potential Listeria contamination. Imperial Caviar also issued a recall and a warning for its products due to the possible presence of dangerous bacteria called Clostridium botulinum.

During recalls, consumers who bought products were advised to return items to stores or discard them altogether. So far, no illnesses have been reported that directly link to the tainted products mentioned above, but the damage concerning public trust has already been done.

Demand for better quality

As the global per capita wealth around the world increases, many people are now willing to pay a higher price for a better quality of food — for meats, seafood and crops, among others. The question is: Will there be enough to meet this surge in demand?

Take shrimp, for instance. The USDA Foreign Agricultural Service reports that approximately nine billion pounds of shrimp are consumed around the world annually. About 1.8 billion of that is in the US alone. However, with this high demand also comes a limited capacity to supply.

Shrimp production has slowed worldwide. Resources and cultivation farms are dwindling due to unsustainable indoor aquaculture methods, overfishing and polluted waters. In the open water method, algal bloom and oil spills pose the biggest challenges.

In the US, 94 percent of shrimp is imported from abroad, especially from areas in Asia and Latin America. Unfortunately, chemicals and antibiotics are used to ensure that shipments will arrive “fresh.”

This only compounds the problem, as bacteria learned to adapt and resist these antibiotics. According to a Bloomberg article in 2016, these “superbugs” are now a reality. Dr Martin Blaser, a professor of microbiology and an infectious diseases physician at New York University Langone Medical Center, said, “People eating their shrimp cocktails and paella may be getting more than they bargained for... The penetration of antibiotics through the food chain is a big problem.”

For the shrimp industry, looking for new ways to raise shrimp — clean, natural, safe, and fresh — are more important now than ever before.

Seeking solutions through aquaculture

This is probably why many shrimp producers are turning to land-based aquaculture (LBA). A Cawthron Institute report describes LBA as “any type of aquaculture that takes place on land, be it for freshwater or marine species.”

One such technology uses ocean or river water which is directed to a land-based facility. It then goes to a containment area of tanks or ponds. The water can be a one-time flow-through or it can also be re-circulated, meaning it will be “recycled through a series of treatment steps and used again.”

While the interest for land-based aquaculture is increasing, translating that interest into investment dollars may be easier said than done. Not too many people see LBAs as a viable source of investment opportunity. Global Outlook for Aquaculture Leadership (GOAL) says that failed startups remain vivid in the memories of some investors which, in turn, breed doubt and has slowed investments into new technologies.

However, some experts remain hopeful. “A few successes will lead to an influx of investment, I think. But there's still a big gap between investors and the mentality needed,” Jamie Stein of Devonian Capital said.

Tinicum’s Michael Donner, on the other hand, suggested that regulations must be relaxed in the US to attract investors. “You can see money flowing into aquaculture, but it's happening in Canada, the Caribbean, Mexico — not in the US.”

Innovation in shrimp aquaculture

Agro-tech company and aquaculture innovator NaturalShrimp, Inc. (OTCMKTS:SHMP) may just be the game-changer of the shrimp industry. The Company focuses on producing fresh shrimp the natural way through its patent-pending proprietary technology called Vibrio Suppression.

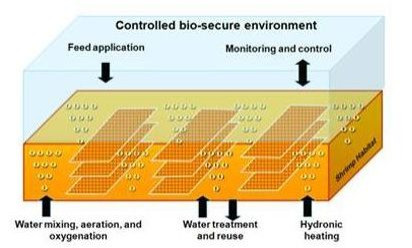

It has developed and tested the first commercially viable system for growing shrimp indoors using proprietary technologies in a facility that produces healthy, naturally grown shrimp without the use of antibiotics or toxic chemicals. Vibrio Suppression mimics the natural ocean environment so that the shrimp can reproduce at the optimal level. The facility is self-contained, which means that there are no disturbances from harsh weather, no diseases, and no pollutants. This technology can produce up to four times more shrimp within the same space as compared to other techniques.

Vibrio Suppression also eliminates the build-up of bacteria in indoor shrimp aquaculture. Without bacteria, the chances of many shrimp diseases are effectively eliminated.

This method is likely to be more sustainable while yielding higher densities and more consistent production. The shrimp are of better quality overall, and their survival rates are higher without the use of chemicals, antibiotics or probiotics, which could potentially be considered contaminated or toxic. As a result, Vibrio Suppression technology is proving to be better than older aquaculture methods such as Biofloc.

Expansion plans

Potential investors might take note that NaturalShrimp plans to build these environmentally green production facilities in major cities throughout the country, including New York, New Jersey area and Las Vegas. The Company intends to complete the first newly designed system at its production facility in La Coste, Texas, via its current capital raise and then construct a full-scale operation at the same site.

Once finished, each US$3.6 million (AU$4.51 million) 24-tank system can produce six thousand pounds of fresh shrimp weekly and is expected to produce an internal return rate of 29 percent annually. Gross profit is projected to be US$1.2 million (AU$1.50 million).

NaturalShrimp is also working on several major international deals to grow and sell shrimp using its patent-pending technology. The company has an established presence in Medina del Campo, Spain.

Dallas-based Executive Chef Michael Scott likened the NaturalShrimp product to sushi-grade Japanese sweet shrimp due to its purity and high quality. “That pretty much says it all,” stated Chef Scott, who has represented NaturalShrimp in various culinary presentations over the years.

Land-based aquaculture is growing, and the upside for a producer like NaturalShrimp appears to be tremendous. NaturalShrimp could be the most profitable and practical answer to the demand for environmentally friendly, clean, fresh shrimp for US and international consumers.

Article sent via press release for consideration.