iPhone, Mac sales drag Apple’s Q3 2016 earnings

Stock price soars 6.6 percent despite negative profit report

Apple reported a 27 percent lesser profit for the third quarter of its current fiscal year as iPhone and Mac sales plummet on Tuesday. The Cupertino, California-based tech giant posted a US$7.8 billion (AU$10.4 billion) net income for the third quarter that ended last June 25.

The figure shows a sharp decline from the US$10.7 billion (AU$14.2 billion) net income Apple has reported during the same period last year, not to mention a 16 percent drop from the company’s second quarter earnings.

This translates to a US$1.42 (AU$1.89) per diluted share, compared to the US$1.85 (AU$2.46) per diluted share recorded for the third quarter of the last fiscal year. Despite this, Apple (NASDAQ:AAPL) stock price closed at US$103.25 (AU$ 137.45) apiece or 6.6 percent higher after trading hours.

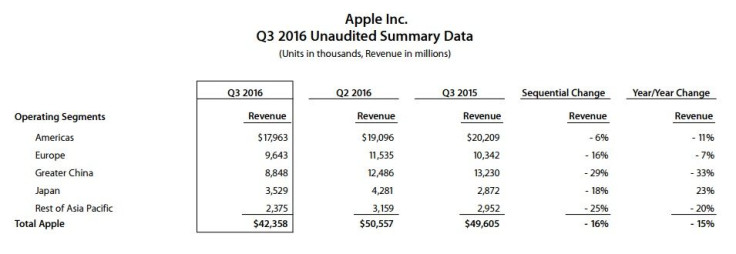

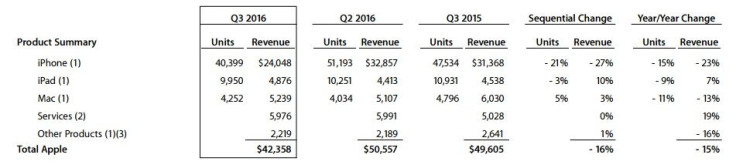

According to Apple’s Third Quarter Results, the company’s net sales declined by 15 percent from US$49.6 billion (AU$66 billion) to only US$42.4 billion (AU$56 billion) as iPhone sales dropped 23 percent and Mac sales fell 13 percent compared to the year-ago figures. Despite negative iPhone sales, Apple CEO Tim Cook claimed that the iPhone SE’s launch in June had been successful.

“We had a very successful launch of iPhone SE and we’re thrilled by customers’ and developers’ response to software and services we previewed at World Wide Developers Conference in June,” he said.

App Store sales hit all-time high

On the other hand, iPad sales increased by 13 percent, and App Store sales contributed 19 percent on Apple’s net sales.

“Our Services business grew 19 percent year-over-year and App Store revenue was the highest ever, as our installed base continued to grow and transacting customers hit an all-time record,” said Luca Maestri, Apple’s CFO.

“We returned over US$13 billion (AU$17 billion) to investors through share repurchases and dividends, and we have now completed almost US$177 billion (AU$236 billion) of our US$250 billion (AU$333 billion) capital return program,” he added.

Apple expects its fourth quarter revenue to range between US$45.5 billion (AU$60.6 billion) and US$47.5 billion (AU$632 billion) with a gross margin between 37.5 percent and 38 percent. In the meantime, Apple is expected to pay shareholders US$0.57 (AU$0.76 ) per share of the company’s common stock on Aug. 11.

Apple is considered the undisputed most profitable publicly-traded company in the world. It ranks third on the latest Fortune 500 list, next to Walmart and Exxon Mobil.