Marissa Mayer determined to turn Yahoo around with cost-cutting measures, but board members signal for sale offers

Spring cleaning is on the books for Yahoo, after its sixth CEO in seven years Marissa Mayer confirmed on Tuesday during the Yahoo Q4 earnings call that she would slash about 1,700 jobs – or 15 percent of Yahoo’s workforce – close five offices, and axe services like Games for an approximate US $1 billion (AU $1.42b).

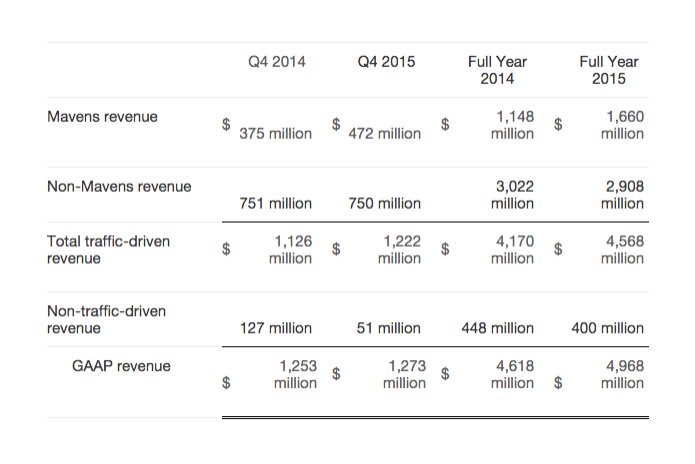

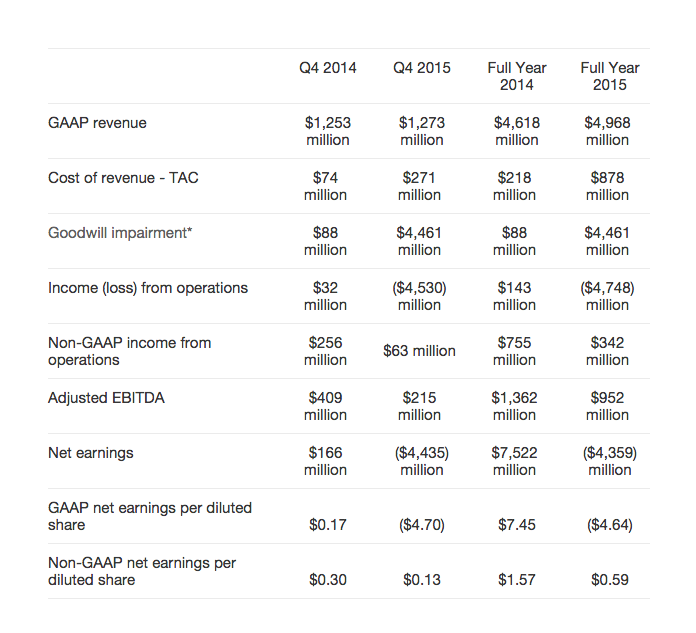

Labeled an “aggressive strategic plan”, the news came as the company reported a stronger than expected revenue of US $1.27 billion – although expectations were low to begin with – at a loss of US $4.43 billion, or $4.70 per share, in the quarter.

Follow us on Twitter

Analysts had expected the Internet giant to come through with US $1.2 billion in revenue, and deliver lowered earnings of 13 cents (which Yahoo pretty much did).

It had earned 30 cents a share in the same period in 2014.

A third of Yahoo’s GAAP revenue was driven by its Mavens (mobile, video, native and social) investments, which will continue to be a focus in 2016.

However, numbers under its non-GAAP income from operations (income excluding one-off expenses such as Tumblr’s goodwill write down by $230 million!), reveal a much darker story about Yahoo’s dramatically declining cash flow. As Fortune points out, between 2014 and 2015, Yahoo recorded a cash flow drop of over 50 percent.

Yahoo “simplifies” workforce, but chairman slyly asks for best offers

Of Yahoo’s four-part strategic plan for growth, the most closely-watched were its plans to “simplify the business” and “efficiently align resources”.

This includes laying off staff by end March and closing offices in Dubai, Mexico City, Buenos Aires, Madrid and Milan, which would leave about 9,000 employees left by December 2016 and save about $400 million a year in short-term operating expenses.

Yahoo is also set to consolidate some Digital Magazines and shut down others. It will furthermore exit Games and Smart TV, which it notes “have not met growth expectations,” and divest non-strategic assets, including selling real estate and other non-core assets to generate between $1-3 billion.

“A simpler product portfolio more focused on Yahoo's strengths will allow the Company to more quickly improve offerings to increase profitability,” the company said in a statement.

“ Yahoo is expected to return to modest and accelerating growth in 2017 and 2018. Yahoo's leadership and Board together believe that by taking these steps, the Company will more quickly realise a significant and positive impact on the trajectory of its transformation.”

These cost-cutting measures, though harsh, did not come as a surprise to many. But what made social media really light up was Chairman of the Board Maynard Webb’s statement, which Fortune notes seemed to say ‘Hey Verizon, AT&T, private equity firms! Please make us a good offer”:

“The Board also believes that exploring additional strategic alternatives, in parallel to the execution of the management plan, is in the best interest of our shareholders. Separating our Alibaba stake from our operating business continues to be a primary focus, and our most direct path to value maximisation.”

This Yahoo earnings report is the long awaited report card for Marissa Mayer

— Seth Fiegerman (@sfiegerman) February 2, 2016

- Tumblr writedown

- Mass layoffs

- Officially up for sale

As Re/code points out, the conflicting sentiments expressed by Mayer and Webbs’ statements are reflective of the internal battle at Yahoo’s top about whether the company's core internet business should just be sold – a move which would make investors such as Starboard, Canyon Capital Advisors, and Mason Capital (the company's seventh largest shareholder) very happy.

“They are emotionally supportive of Mayer and her desire to keep at it, but some of the board…[have] had enough,” a source close to the situation told Re/code.

And then there is the issue of Mayer herself. The former Google star has given no indication she will step down, but the calls for her to be laid off are growing increasingly louder.

Hey guys, shall we buy Yahoo? https://t.co/UApk3lUD2O

— Jemaine Clement (@AJemaineClement) February 3, 2016

Since the company’s earnings call, Yahoo’s shares have fallen by about 2.75 percent, leaving it down more than 30 percent over the last year, and down 12 percent in 2016.

So, to summarize, in short, Yahoo is pursuing additional strategic alternatives to strategic proposals for qualified specific proposals. Ok?

— Paul Kedrosky (@pkedrosky) February 2, 2016