Janet Yellen has certainly jump started the markets, with the DOW and S&P adding 0.7% and 0.5% overnight respectively.

In US economic data, consumer credit rose by $17.5 billion in March to $3.14 trillion - this was the largest increase since February 2013. Revolving credit -which measures credit card usage - rebounded by $1.1 billion in March.

The Australian share market was sold off today following falls on US and European markets on fears some stock market valuations are too high.

Sydney man, Michael William Hull, was charged with insider trading – ASIC

The Australian sharemarket is recording its most substantial losses in close to a month, with a weak lead from the U.S. last night and worse than expected local data not helping. The All Ordinaries Index (XAO) is down 1 per cent and is flirting with the key 5400pt mark.

The breakdown of high price momentum trading is an interesting thematic that has been developing over the last six to eight weeks.

Unlike Australian Tax Office employees whose too sexy or casual attire good only for the beach has been noticed by no less than their boss, in air carrier Cathay Pacific, it is the other way around.

Tuesday's session saw a tussle between buyers and sellers, albeit it was an exchange that took place with the index occupying positive territory over the session. Volumes were conspicuously low with only $3.3bln in shares having changed hands. As the session drew to a close the ASX 200 found some comfort in the RBA statement that accompanied its decision to leave rates on hold, although the substance of the text varied little in the last month. The Reserve Bank left the official cash rate on ...

The Australian sharemarket is improving for the third consecutive day, with the All Ordinaries Index (XAO) up 0.3 per cent. The market is treading water ahead of the Reserve Bank's monetary policy meeting this afternoon. Economists are widely expecting the RBA to keep interest rates on hold this month.

With Japan still closed for public holidays by observing Greenery Day, Australia's May data day will be the biggest market macro news on the boards.

In US economic data, the ISM services index rose from 53.1 to an 8-month high of 55.2 in April, and above forecasts for a result near 54.1. The employment trends report rose from 117.5 to 118.0 in April.

Middle Eastern air carrier Etihad launched on Monday a new service in Abu Dhabi, The Residence, which offers a 11.6-square metre 3-room upper deck cabin on its Etihad A380 jet. It has a living room, separate double bedroom, ensuite shower room and even an academy-trained personal butler, travel concierge and chef.

The Australian Customs and Border Protection Service (ACBPS) intercepted an illegal shipment of weapons from China into the country. The contraband includes 5,400 knuckled dusters and 790 tasers that looked like iPhones and torchers.

The Australian sharemarket has kicked off the trading week modestly higher, in what has been a very light day of trade for local stocks. The All Ordinaries Index (XAO) rose by 0.1 per cent. Volume was light partly due to market closures in a number of major markets. A public holiday in Japan, South Korea and the U.K. will keep their markets closed today. U.S. equities failed to rise on Friday despite the most significant monthly jobs growth in over two years. Continued concerns surrounding Ukrai...

The ASX 200 has given up its early gains on Monday to be trading almost by 0.2% lower as investors focus on banking stocks.

Westpac (WBC) shares have fallen more than 1% after having initially risen by 0.8%. The bank reported first-half cash earnings rising by 8 per cent to $3.77 billion in the face of tighter margins.

288,000 jobs were added to the US work force in the month of April - the largest print since June 2010. This saw the unemployment rate fall below the 6.5% threshold to 6.3% for the first time since October 2009.

In US economic data, non-farm payrolls (employment) rose by 288,000 in April, the best gain since January 2012 and well above forecasts for a gain of 210,000. The unemployment rate fell from 6.7% to a 5-1/2 year low of 6.3%. But less people looked for work with the participation rate falling from 63.2% to 62.8%. Factory orders rose by 1.1% in March.

The Australian share market closed only slightly firmer by the close of trade on Friday, but closed the week down 1.4 per cent, erasing all of last week's 1.3 per cent gain.

A flat open for the ASX 200 has gave way to selling in the early part of trade on Friday. US markets finished on a cautious note as investors ruminate on the outcome of the US jobs report which will be released later this evening local time. Most sectors were in the red, although financials were conspicuous with their decline.

With most of Europe and parts of Asia shut for May Day holidays, leads are coming from the US alone; and with China still observing Labour Day holidays, trade is likely to see positioning before the non-farm payrolls.

In US economic data, the ISM manufacturing index rose from 53.7 to 54.9 in April. The forward-looking new orders index and the employment sub index continued to expand at a healthy pace. US construction spending increased by 0.2% in March. Public construction hits its lowest levels since 2006. However this was offset by private residential construction lifting to the highest levels since May 2008.

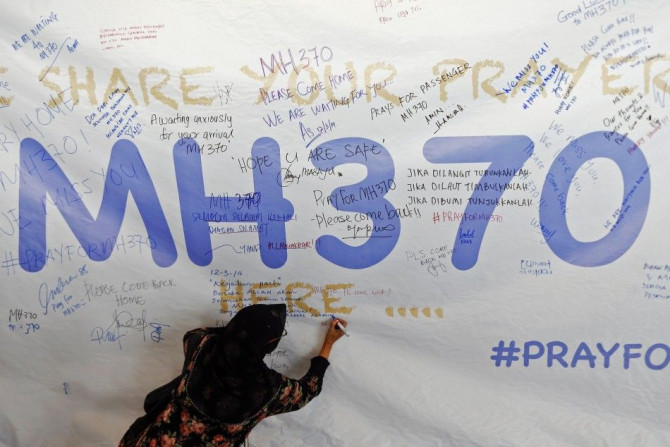

Embattled Malaysia Airlines is expected to elicit more negative feedback from the relatives of the 239 people aboard the missing Boeing 777 jet with two new developments on Thursday.

After more than 50 days of searching the Indian Ocean and not finding any trace of the missing Malaysian Airlines Flight 370, is the embattled air carrier throwing in the towel?

It was another session where the early trend showed few signs of changing course after the opening bell sounded. With less than half an hour to trade the ASX 200 continued the plumb new lows for the session , the market finished within 10 points of the lowest levels of the day.

The Australian sharemarket is losing ground for the second time this week, with the mining and financials the biggest drags on trade. The All Ordinaries Index (XAO) is down 0.4 per cent and is trading below 5450.0pts.

With roughly only 24 months to go, the International Olympic Committee is wondering if Rio de Janeiro will ever be able to complete its preparations in time for the 2016 Olympic Games. An IOC senior official has blasted the country's preparations for the global games as the worst ever that he has seen so far.

Currently, when materials are up, financials reverse and vice versa; for Australia today, it appears that the banks will be up, and materials down.

In US economic data, the economy grew at a 0.1% annual pace in the year to March, short of forecasts for a gain of 1.2%. The ADP survey showed that 220,000 private sector jobs were created in April, above forecasts for a gain of 210,000. Employment costs rose by 0.3% in the March quarter, below forecasts for a gain of 0.5%.

The New South Wales government announced on Wednesday the sale of the Newcastle Port, the world's biggest coal export terminal, for $1.62 billion to joint venture partners Hastings Fund Management and China Merchants.

The Australian share market finished only marginally higher on Wednesday, despite good gains offshore. US market sentiment was buoyed by earnings news with the Dow Jones Index up 0.5 per cent.