PotNetwork Holdings' faith in the cryptocurrency market pays off amid boom

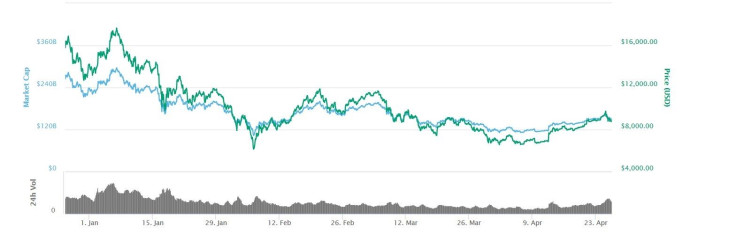

Despite experiencing incredible gains towards the end of 2017, the cryptocurrency market has struggled through the first quarter of 2018. A large market dip in January has been followed by a period of relatively anaemic growth.

Although market was considered bearish, a number of different companies, including PotNetwork Holdings Inc. (OTCMKTS:POTN), took a calculated risk and opted to set up subsidiaries focused on cryptocurrency mining operations.

Now their brave move appears to be paying off. In April, the cryptocurrency market has shown tentative signs of a recovery and the value of Bitcoin has begun to nudge back towards the US$10,000 (AU$13,300) mark. As faith in this unstable market recovers, investments in cryptocurrency mining could begin to pay off.

How cryptocurrency mining works

Cryptocurrency mining is an essential part of the blockchain ecosystem. Most mainstream cryptocurrencies, such as bitcoin and Ethereum, use a process known as Proof of Work (PoW). This involves a huge number of computers competing to solve complex equations. Once a computer (or miner) solves the equation a block of transactions is processed and the miner is rewarded for their efforts with some cryptocurrency.

If there are not enough miners processing transactions, then a cryptocurrency will experience extreme slow-downs or transaction bottlenecks. This gives miners a lot of influence over the direction of coins like bitcoin. Without them and their computing power, there is the very real risk that a cryptocurrency could die.

When bitcoin first started, there were large numbers of small miners simply using their own computers to mine cryptocurrency. Unfortunately, as time has gone on it has become significantly more difficult to process transactions. This has led to large mining farms, primarily based in China, taking over the majority of transactions on the network. Some view this concentration of power as a threat to the bitcoin ecosystem.

The key barrier for most miners is the cost of electricity. Cryptocurrency mining is very energy intensive, Bitcoin mining alone consumed more energy than all of Ireland in 2017. This has led to a concentration of mining facilities in areas with low energy costs, such as China and Canada. High energy bills have also helped to ensure that large mining farms are the most profitable way to acquire cryptocurrency.

Both bitcoin and Ethereum are facing major scalability problems. During the height of the Bitcoin craze in late 2017, transaction times had increased to 30 minutes or longer and the fees were beginning to become unmanageable. This has raised serious concerns as to whether bitcoin can be truly viable as a currency, especially as block rewards continue to decrease. This creates an opening in the market for new companies to set up mining farms focused not just on bitcoin and Ethereum but also the plethora of smaller altcoins.

Why many companies want to set up cryptocurrency mining farms

There are three main ways a company can profit using blockchain technology. The first is to create a blockchain solution to an existing problem and fundraise using an initial coin offering (ICO). The second is to directly invest in cryptocurrency and sell as the value increases. The third is to invest in a cryptocurrency mining farm.

Many companies have opted to go for the third option. This is largely because cryptocurrency mining requires less technical knowledge than the creation of an ICO and offers a better potential return on investment than simply buying cryptocurrency. That being said, a mining farm is expensive to set-up and maintain and requires an extraordinary amount of electricity.

Despite the high set-up costs, a cryptocurrency mining facility has a few key advantages. The primary reason for setting up a mining farm is that it allows a company to acquire a large amount of cryptocurrency over a long period of time for a relatively low cost. They are then able to hold onto significant portions of their cryptocurrency and liquidate it at a time when the market is high.

Another advantage that large mining groups have is that they are able to redeploy their mining rigs to target whatever cryptocurrency is most profitable at any given moment. This allows the company to acquire a large balanced portfolio at a fraction of the cost that it would have taken to buy the tokens outright.

There are certain risks associated with cryptocurrency mining. The most obvious are the maintenance costs of specialised computers but there are other risks. Many cryptocurrencies, such as Ethereum, are moving towards the less energy intensive Proof of Stake (PoS) system and wide-scale adoption of this consensus method could make mining farms obsolete. With that in mind, it is difficult to create a truly secure PoS protocol so it is likely that traditional PoW mining will continue into the near future.

There are many exciting companies in this sector

A number of different companies have made attempts to enter into the cryptocurrency mining market over the last year. Some, such as Vapor Group, Inc. have taken steps to create a highly flexible cryptocurrency mining solution. Their subsidiary, CryptoTech Currency, is designed to mine as many cryptocurrencies as possible.

The approach taken by PotNetwork Holdings Inc. (OTCMKTS:POTN) is similar. The primarily CBD-focused company took steps to diversify their holdings with the creation of their wholly owned subsidiary the Blockchain Crypto Technology Corporation. P otNetwork acquired 115 dedicated cryptocurrency mining rigs (ASICs) in order to create their own flexible cryptocurrency mining farm. For the moment their farm focuses on mining bitcoin, but it is being geared up to rapidly switch to a variety of altcoins if Bitcoin mining proves to be less profitable.

servers2 from Shayne on Vimeo.

One of the key advantages of PotNetwork’s Ucrypto mining pool is that it is highly energy optimised. This will be key in reducing the overheads of the company. It also helps to mitigate any potential environmental impact from PotNetwork Holding’s crypto mining operations. This ensures that the company continues to meet its long-standing commitments to the environment and corporate social responsibility.

PotNetwork Holdings has shown significant foresight with their moves into the cryptocurrency segment. The company has already had great success in the CBD industry and by targeting another lucrative, emerging market they are playing to their strengths. It will take time for the cryptocurrency farm to generate significant returns, but it is an excellent long-term play by a company that very much plans for the future.

Press releases for this article were sent for consideration.