Arizona Sonoran Announces a Positive Pre-Feasibility Study for the Cactus Mine Project with a US$509M Post-Tax NPV and 55 kstpa Copper Cathode over 21 Years

CASA GRANDE, Ariz. & TORONTO--(BUSINESS WIRE)--$ASCU #Arizona--Arizona Sonoran Copper Company Inc. (TSX:ASCU | OTCQX:ASCUF) (“ASCU” or the “Company”) today announced it has completed its NI 43-101 Prefeasibility Study (“PFS”) for its Cactus Project in Arizona, USA. The Standalone PFS outlines a lower risk, top 10 potential copper operation in the domestic USA, producing LME Grade A copper cathodes onsite via heap leach and a Solvent Extraction/Electrowinning (“SXEW”) plant. All dollar amounts referenced herein in US dollars, and all references to tons are short tons, unless otherwise noted.

The Company intends to file a technical report (the “Technical Report”) in respect of the PFS in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) on SEDAR+ (www.sedarplus.ca) under the Company’s issuer profile and the Company’s website within 45 days of the date of this news release.

A webinar will be held on February 22, 2024, at 10:00 am ET. Please join George Ogilvie, Nick Nikolakakis, Bernie Loyer and Anthony Bottrill in discussion of the PFS and the Company’s next steps by registering here https://www.bigmarker.com/vid-conferences/ASCU-VID-THF.

Cactus PFS Highlights

Scalable, Long-Life Operations

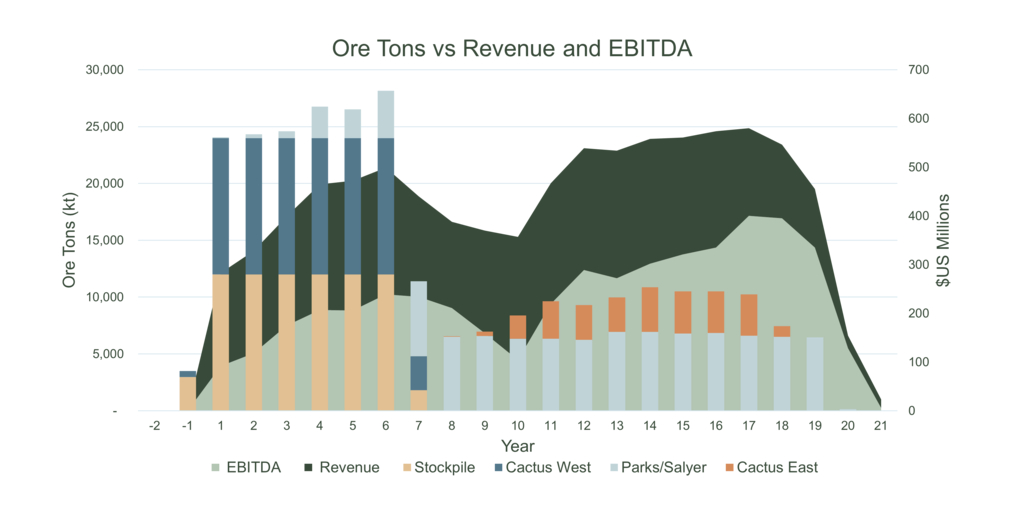

- Average annual production of approximately 55 ktons or 110 million pounds (“lbs”) of copper (“Cu”), with a peak of 74 ktons or 149 million pounds of copper

- Initial Life of Mine (“LOM”) 21 years, recovering 1,153 ktons or 2.31 billion pounds of Copper LME Grade A cathode onsite via heap leach facility and SXEW

- Maiden Proven & Probable (“P&P”) Reserves of 276.3 million tons at 0.48% Soluble Copper (“Cu TSol”) or 3.0 Billion lbs Copper

- Favourable metallurgy with a range of 85%-92% LOM average soluble copper recoveries

- Private land ownership with streamlined permitting process

-

Low carbon footprint mining project:

- Powered by an existing 69 KV Transmission line with access to “Green Energy” through the Palo Verde Nuclear Plant West of Phoenix for costs of $0.07/kWh

- Heap Leach and SXEW Process

- Conveyors and radial stackers used to move ore to leach pads

Robust Economics

- First quartile capital intensity of $10,343/tonne of average annual production

- Total initial capital cost of $515 million, including $75 million of contingencies over an 18-24 month construction period

- Total revenues of $9.0 billion over 21 years

- Post-tax unlevered Free Cash Flow of $2.4 billion

- C1 Cash Costs of $1.84/lb and All in Sustaining Cost (“AISC”) of $2.34/lb

-

Post-tax net present value (“NPV”) $509 million (CA$687 million) using an 8% discount rate and an internal rate of return (“IRR”) of 15.3% and using a $3.90/lb flat long-term copper price

- Pre-tax NPV $733 million (CA$990 million)

- Post-tax payback period of 6.8 years from initial production

- At $4.25/lb Copper the NPV increases to $780 million post-tax (CA$1,054 million) and $1,064 million pre-tax (CA$1,436 million), using an 8% discount rate

Significant Copper Project in the USA

- Proven & Probable (“P&P”) Reserves of 276.3 million tons at 0.48% Soluble Copper (“Cu TSol”) or 3.0 Billion lbs Copper

- Underground Proven Reserve grade of 0.89% and 0.82% Cu TSol from Cactus East and Parks/Salyer, respectively

- Measured & Indicated Resources of 5.2 billion lbs Copper and Inferred Resources of 2.2 billion lbs Copper (as announced October 16, 2023) (inclusive of reserves)

Future Opportunities to Further Improve Business Case

- Drilling to upgrade known inferred resources and bring them into the mine plan potentially increasing the LOM production, reducing underground development costs, operating expenses, capital expenses and overall strip ratio

- Drilling to prove a maiden resource at MainSpring as a potential open pit providing operational flexibility and gaining lower cost access to the Parks/Salyer deposit. Bringing MainSpring into the mine plan potentially improves operational and financial synergies within the Cactus Project

- Continued exploration success on the Cactus Project in the “Gap Zone”, below the envelope of the existing Cactus West Open Pit Shell and in the North-East Extension.

- Nuton LLC’s (“Nuton") leaching technology driving primary sulphide optionality, currently excluded from the mine plan

George Ogilvie, ASCU President and CEO commented, “The 55,000-ton Copper Cathode per annum mine plan presented in the PFS illustrates an achievable long-life operation with robust economics and an opportunity for continued scaling of the asset. Our operation has the potential to be among the top 10 copper operations within the US, supplying the domestic supply chain with copper cathodes in the near term. With global copper mine disruptions occurring and a structural deficit currently underway, our timing to develop the asset has a high likelihood to coincide with much higher copper incentive prices. As compared to the original PEA, the PFS demonstrates a significant increase of free cash flow at a conservative long-term copper price assumption of $3.90 per pound.”

He continued, “A real organic growth opportunity exists within our 5,370 acres at the MainSpring Property. Based on initial drilling of our MainSpring property there are early indications for Mainspring to be the southern near surface extension of our Parks/Salyer deposit and thus will be a focus of drilling in 2024. Through our 2024 drilling programs, our team has the potential to convert the 1.3 billion pounds of leachable inferred resources of copper to the indicated resources category, contributing to an extended mine life. Over and above, ASCU also looks forward to the continued metallurgical testing and incorporation of the Nuton technology to our Cactus flowsheet, which if executed, lowers our cost of capital, provides a funding partner for the initial capex and ongoing operating costs, as well as provides execution support from a top global mining partner.”

“With this cornerstone now placed, we are excited to continue building Cactus, which today is a significant asset, with plenty of future optionality to continue upgrading the asset with scale.”

Bernie Loyer, ASCU SVP Projects notes “Our Cactus Project PFS demonstrates a solid business case, and the potential to deliver a long-life operation utilizing a well-established and industry proven process technology in the treatment of ore from four separate and well understood feed sources. All situated on privately held ground, this brownfield project site located within 45 minutes of the Phoenix city center which is the 10th largest metropolitan area within the United States, is wrapped with an enviable complement of all required infrastructure. Add to all of that, a project team with a strong combination of project and operational experience on complex mining projects throughout North and South America, and the foundation for the Cactus Project and future operation is well-placed.”

Pre-Feasibility Summary

The 2024 PFS outlines a lower risk and long-life copper project with low first quartile capital intensity. The heap leach operation will produce on average 55 kstpa of LME Grade A copper cathodes via SXEW. Key metrics are shown in TABLE 1 below.

Conventional open pit mining methods have been selected for the extraction of oxide and secondary sulphide material from the lower grade Cactus West pit, while the higher-grade Parks/Salyer and Cactus East deposits will be mined via underground using the Sublevel Caving (“SLC”) method from the 1,500 ft (457 m) and 1,200 ft (366 m) levels, respectively. Reserve grades of the Parks/Salyer and Cactus East deposits are high grade, at 0.93% CuT and 0.95% CuT, and 0.82% Cu TSol and 0.89% Cu TSol, respectively. The Stockpile will be a rehandling exercise moving low grade tonnage to a lined pad for leaching. Onsite facilities at the mine site will consist of an open pit, underground mining operations, a fine crushing plant incorporating all crushing, classification, agglomeration and conveying systems and an SXEW process plant. On site supporting infrastructure will include site power distribution, access roads and heap leach facilities.

Table 1: 2024 PFS Highlights

Financial Metrics | Unit | PFS LOM |

Copper Price Assumption | $/lb | $3.90 |

Revenue | $ millions | $8,994 |

Operating Costs* | $ millions | $4,029 |

EBITDA | $ millions | $4,746 |

Unlevered FCF (pre-tax) | $ millions | $3,099 |

Unlevered FCF (post-tax) | $ millions | $2,407 |

Base Case Economics | ||

Pre-tax NPV(8%) | $ millions | $733 |

Pre-tax IRR | $ millions | 17.7% |

NPV / Initial Capital (post-tax) | Ratio | 1:1 |

Post-tax NPV(8%) | $ millions | $509 |

Post-tax IRR | % | 15.3% |

Post-tax Payback Period** | Years | 6.8 |

Initial Capital | $ millions | $515 |

Sustaining Capital (primarily UG) | $ millions | $1,221 |

Effective Tax Rate | % | 22.3% |

Production | ||

Construction Period | Months | 18-24 |

Mine Life | Years | 21 |

Total Mineralized Material | Millions tons | 276.3 |

Cu Avg Production (Years 1-5) | Millions lbs/year | 100 |

Cu Avg Production (Years 6-10) | Millions lbs/year | 105 |

Cu Avg Production (Years 11-15) | Millions lbs/year | 136 |

Average Annual LOM Production | Millions lbs / ktons | 110 / 55 |

Total Payable Copper | Million lbs | 2,306 |

Average Head Grade | % Cu TSol | 0.48% |

Open Pit Strip Ratio | Waste:Ore | 1.96 |

Costs | ||

LOM C1 Cash Costs*** | $/Cu lb | $1.84 |

LOM All-in Sustaining Costs**** | $/Cu lb | $2.34 |

Mining | ||

Open Pit | $/ ton mined | $2.20 |

Underground | $/ ton mined | $20.21 |

Leaching & Processing | $/ ton placed | $2.96 |

General & Administrative | $/ ton placed | $0.12 |

kt = thousands of short tons; kstpa = thousands of short tons per annum

FOREX Conversion = US $1.00 = CA $1.35

* Operating cash costs consist of mining costs, processing costs, and G&A

** Payback period exclusive of construction

*** Total cash costs consist of operating cash costs plus transportation cost, royalties, treatment and refining charges

**** AISC consist of total cash costs plus sustaining capital, closure cost and salvage value

TABLE 2: Pre- and Post-Tax Sensitivity to the Copper Price

$3.75 | $3.90 | $4.00 | $4.25 | $4.50 | $4.75 | |

Pre-tax | ||||||

NPV(8%), $m | $592 | $733 | $828 | $1,064 | $1,299 | $1,535 |

Post-tax | ||||||

NPV(8%), $m | $389 | $509 | $587 | $780 | $971 | $1,162 |

IRR, % | 13.6% | 15.3% | 16.5% | 19.3% | 22.1% | 24.9% |

Payback years1 | 7.4 | 6.8 | 6.4 | 5.7 | 5.2 | 4.8 |

1 Payback period calculated starting from start of commercial production

Project Overview

The Cactus Mine Project is a brownfield project located approximately 6 mi (10 km) northwest of the city of Casa Grande and 40 road miles south-southwest of the Greater Phoenix metropolitan area in Arizona. The Cactus Mine Project is accessible on North Bianco Road off of West Maricopa-Casa Grande Highway with direct access to interstate highway 10. During historic ASARCO operations (1974-1984), a rail spur was connected directly with the United Pacific Railroad to ship concentrates to its El Paso refinery in Texas; while the spur has been removed, the onsite rail line is still in existence. Current onsite infrastructure includes power lines and substation, water wells and a water pond, geological buildings, core sheds and administrative offices, keeping the capital intensity low and demonstrating robust economics.

Since 2019, ASCU has drilled 141 new holes at the Cactus West and East deposits to support verification, metallurgical testing, and resource extension for the Cactus mineral resource estimate. The Parks/Salyer resource database is composed primarily of 74 new holes drilled by ASCU between late 2020 and 2023. The historical ASARCO holes for the district comprised of 171 drillholes. The bulk of these holes were in the Cactus West and Cactus East deposits or comprised regional exploration holes. An extensive verification and re-assay programs were undertaken to support the use of historical drilling in resource estimates. Since 2020, ASCU has drilled 514 sonic drillholes to support resource estimates on the stockpile. In addition to verification of historical drilling, for all ASCU holes physical checks on collar, downhole survey, logging, and assay quality assurance and quality control (“QA/QC”) have been completed by the qualified person.

The Cactus Mine Project is host to a large porphyry copper system that has been dismembered and displaced by Tertiary extensional faulting. The major host rocks are Precambrian Oracle Granite and Laramide monzonite porphyry and quartz monzonite porphyry. The mine trend features the formation of horst and graben blocks of mineralization where the Cactus deposits are situated, extending from the Cactus East deposit, southwest to the Parks/Salyer deposit. Drilling to the northeast and southwest along the trend indicates that mineralization continues in both directions and at depth at the Cactus West deposit.

Reserves and Resources

The PFS is based on the updated 2023 Mineral Resource Estimate (“MRE”), as published on October 16, 2023, showing a 221% increase of leachable Measured and Indicated (“M&I”) pounds over the mineral resource base used in the 2021 PEA. The Mineral Resources and Reserves for the Cactus Mine Project are shown in TABLES 3 and 4 and illustrated in FIGURE 3 below.

Table 3: Cactus Project Total Measured, Indicated and Inferred Mineral Resource

Material

|

ktons

|

CuT

|

TSol

|

Contained Cu

|

Total Resources | ||||

MEASURED | ||||

Total Leachable | 9,100 | 0.230 | 41,900 | |

Total Primary | 1,300 | 0.315 | 8,000 | |

Total Measured | 10,400 | 0.241 | 49,800 | |

INDICATED | ||||

Total Leachable | 348,500 | 0.629 | 4,387,200 | |

Total Primary | 86,800 | 0.425 | 737,000 | |

Total Indicated | 435,300 | 0.589 | 5,124,200 | |

M&I | ||||

Total Leachable | 357,600 | 0.619 | 4,429,000 | |

Total Primary | 88,000 | 0.423 | 745,000 | |

Total M&I | 445,700 | 0.580 | 5,174,000 | |

INFERRED | ||||

Total Leachable | 107,700 | 0.607 | 1,307,900 | |

Total Primary | 126,200 | 0.357 | 900,000 | |

Total Inferred | 233,800 | 0.472 | 2,207,900 | |

| Notes: | |

1. | Leachable copper grades are reported using sequential assaying to calculate the soluble copper grade. Primary copper grades are reported as total copper, Total category grades reported as weighted average copper grades of soluble copper grades for leachable material and total copper grades for primary material. Tons are reported as short tons. |

2. | Stockpile resource estimates have an effective date of 1 March 2022, Cactus resource estimates have an effective date of 29th April 2022, Parks/Salyer resource estimates have an effective date of 19th May 2023. All resources use a copper price of US$3.75/lb. |

3. | Technical and economic parameters defining resource pit shell: mining cost US$2.43/t; G&A US$0.55/t, 10% dilution, and 44°-46° pit slope angle. |

4. | Technical and economic parameters defining underground resource: mining cost US$27.62/t, G&A US$0.55/t, and 5% dilution. |

5. | Technical and economic parameters defining processing: Oxide heap leach (HL) processing cost of US$2.24/t assuming 86.3% recoveries, enriched HL processing cost of US$2.13/t assuming 90.5% recoveries, Primary mill processing cost of US$8.50/t assuming 92% recoveries. HL selling cost of US$0.27/lb; Mill selling cost of US$0.62/lb. |

6. | Royalties of 3.18% and 2.5% apply to the ASCU properties and state land respectively. No royalties apply to the MainSpring (Parks/Salyer South) property. |

7. | For Cactus: Variable cutoff grades were reported depending on material type, potential mining method, and potential processing method. Oxide material within resource pit shell = 0.099% TSol; enriched material within resource pit shell = 0.092% TSol; primary material within resource pit shell = 0.226% CuT; oxide underground material outside resource pit shell = 0.549% TSol; enriched underground material outside resource pit shell = 0.522% TSol; primary underground material outside resource pit shell = 0.691% CuT. |

8. | For Parks/Salyer: Variable cut-off grades were reported depending on material type, associated potential processing method, and applicable royalties. For ASCU properties - Oxide underground material = 0.549% TSol; enriched underground material = 0.522% TSol; primary underground material = 0.691% CuT. For state land property - Oxide underground material = 0.545% TSol; enriched underground material = 0.518% TSol; primary underground material = 0.686% CuT. For MainSpring (Parks/Salyer South) properties - Oxide underground material = 0.532% TSol; enriched underground material = 0.505% TSol; primary underground material = 0.669% CuT. |

9. | Mineral resources, which are not mineral reserves, do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, sociopolitical, marketing, or other relevant factors. |

10. | The quantity and grade of reported inferred mineral resources in this estimation are uncertain in nature and there is insufficient exploration to define these inferred mineral resources as an indicated or measured mineral resource; it is uncertain if further exploration will result in upgrading them to an indicated or measured classification. |

11. | Totals may not add up due to rounding. |

As shown in TABLE 4 below, a total of 276 million short tons or 3.0 billion pounds were converted into a P&P Reserve out of the leachable M&I Resource base of 4.43 billion lbs, representing a conversion rate of 68%. The Inferred material and primary sulphides are treated as waste, with conversion drilling at Cactus West, a focus for 2024 as part of the dual track ASCU/Nuton Work Plan as announced on January 30, 2024. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

Table 4: Cactus Mine Project Reserves Statement by Deposit

Unit | Cactus West Open Pit | Stockpile Open Pit | Cactus East Underground | Parks/ Salyer Underground | Totals | |

Proven | Tons | 3,600,000 | 3,600,000 | |||

CuT (%) | 0.249 | 0.249 | ||||

Cu TSol (%) | 0.225 | 0.225 | ||||

Cu (M lbs) | 17.9 | 17.9 | ||||

Probable | Tons | 71,921,000 | 76,777,000 | 27,739,000 | 96,248,000 | 272,686,000 |

CuT (%) | 0.310 | 0.163 | 0.950 | 0.930 | 0.552 | |

Cu TSol (%) | 0.260 | 0.136 | 0.885 | 0.820 | 0.487 | |

Cu (M lbs) | 445.4 | 251.0 | 527.0 | 1,789.7 | 3,013.0 | |

Proven + Probable | Tons | 75,521,000 | 76,777,000 | 27,739,000 | 96,248,000 | 276,286,000 |

CuT (%) | 0.307 | 0.163 | 0.950 | 0.930 | 0.549 | |

Cu TSol (%) | 0.259 | 0.136 | 0.885 | 0.820 | 0.484 | |

Cu (M lbs) | 463.3 | 251.0 | 527.0 | 1,789.7 | 3,031.0 |

Notes to the Mineral Reserves:

1. | Mineral Reserves have an effective date of November 10, 2023. The Qualified Person for the underground estimates of Cactus East and Parks/Salyer is Nat Burgio of AGP Mining Consultants Inc. The Qualified Person for the open pit estimates of Cactus West and Stockpile is Gordon Zurowski of AGP Mining Consultants Inc. |

2. | The Mineral Reserves were estimated in accordance with the CIM Definition Standards for Mineral Resources and Reserves. |

3. | The Mineral Reserves are supported by a combined open pit and underground mine plan, based on open pit and underground designs and schedules, guided by relevant optimization procedures. |

Inputs to that process are: | |

| |

| |

| |

| |

| |

| |

| |

4. | The footprint delineations for the Cactus East and Parks/Salyer mines were based on a resource model block cash flow dollar value (CFTC1) of $27.62 (net of process, G/A and royalties). Drawpoints were shut-off when the grade value fell below a CFTC1 of $27.62 following the necessary removal of swell material within the footprint. |

5. | Dilution and mining loss adjustments are incorporated into the underground mining inventories by way of cave flow modelling software. Inferred resources included in the mixing process have been assigned zero grade. No allowance for mining dilution or ore loss has been provided in the open pit mining inventories. |

Mining Operations

The Cactus Mine plan includes production from four separate mining areas: Cactus West Open Pit, Historical Stockpile, Cactus East Underground, and Parks/Salyer Underground. Ore processing in the mine schedules involves oxides and secondary sulphides being processed on a heap leach after multi-stage crushing.

The mine production schedule is initially focused on the surface sources of ore (Stockpile and Cactus West Open Pit) beginning in year -1, along with Parks/Salyer underground starting development in Year 1. The Cactus East deposit is developed later in the mine life, starting in Year 8. Cactus West and the Stockpile ore sources are depleted in Year 7 after which the ore stream becomes exclusively underground. The overall site layout is shown in FIGURE 8.

The Cactus West mine life consists of 2 phases and includes one year of pre-stripping and seven years of mining. Phase 1 starts with 24 million tons (“Mt”) of pre-production stripping and is completed in Year 4. Phase 2 mining begins in Year 2 and is mined out in Year 6. Target ore production is 12 Mt per annum with a peak mining rate of 47 Mt in Years 2 and 3. A total of 75.5 Mt of leach ore grading 0.307% total copper is mined at a strip ratio of 1.9 to 1. Bench elevations at Cactus West range from the 1,440-ft level to the 380-ft level.

Over the course of the open pit mine schedule, approximately 13.1 Mt of low-grade ore is stockpiled and reclaimed in order to smooth the ore release from the open pits. This amount includes approximately 3.0 Mt of material stockpiled in the first three years of mining, and then processed in Year 3 and 4, and another 10 Mt stockpiled later in the mine schedule before being reclaimed in Years 7 and 8.

Historic Stockpile (FIGURE 5) mining begins near the end of the pre-production year with approximately 3.0 Mt of ore sent to the leach pad. Mining continues concurrently with the Cactus West pit into Year 7 at an annual ore production rate of 12 Mt. A total of 76.8 Mt of leach ore at 0.163% total copper is mined. A small amount, 5.5 Mt of waste is mined from the historic stockpile and sent to the waste storage areas.

The initial Parks/Salyer SLC (FIGURE 6) level will commence at 1,120 ft (341 m) below surface and include 11 sublevels to a final depth of 1,930 ft (588 m) below surface. Access to the Parks/Salyer deposit will be via a surface portal and twin declines. One decline will be dedicated to ore haulage using an inclined conveyor and the other decline providing access for personnel and equipment. Production extends from year 1 to 20, with steady state production beginning in year 7 to year 20, peaking at 6.9 Mtpa in year 13. A total of 96 Mt of leach ore @ 0.82% Cu TSol will be processed.

The initial Cactus East SLC (FIGURE 7) level will commence in year 9 at 1,325 ft (404 m) below the surface and will be comprised of 7 sublevels to a final depth 1,845 ft (562 m) below surface. Access will be via a single decline with a portal located within the existing Cactus West pit. Ore haulage to surface will be via a vertical conveyor which can be supplemented with truck haulage to surface via the open pit if necessary. Production is planned from year 9 to 19, with steady state production beginning in year 12, peaking at 3.9 Mtpa in year 15. A total of 28 Mt of leach ore @ 0.89% Cu TSol will be processed.

SLC production crosscuts have primarily been designed so that each level is horizontally offset from the level above and below. The design parameters for the SLC production drives at Cactus East and Parks/Salyer are in line with other SLC operations.

Contacts

For more information

Alison Dwoskin, Director, Investor Relations

647-233-4348

adwoskin@arizonasonoran.com

George Ogilvie, President, CEO and Director

416-723-0458

gogilvie@arizonasonoran.com

Read full story here