UK Inflation Slowdown Unlikely To Shift Vote, Rate Outcomes

Britain's inflation rate has slowed to a near three-year low, official data showed Wednesday, but the boost for embattled Prime Minister Rishi Sunak was unlikely to prevent his Conservatives from losing the upcoming general election to Labour, analysts said.

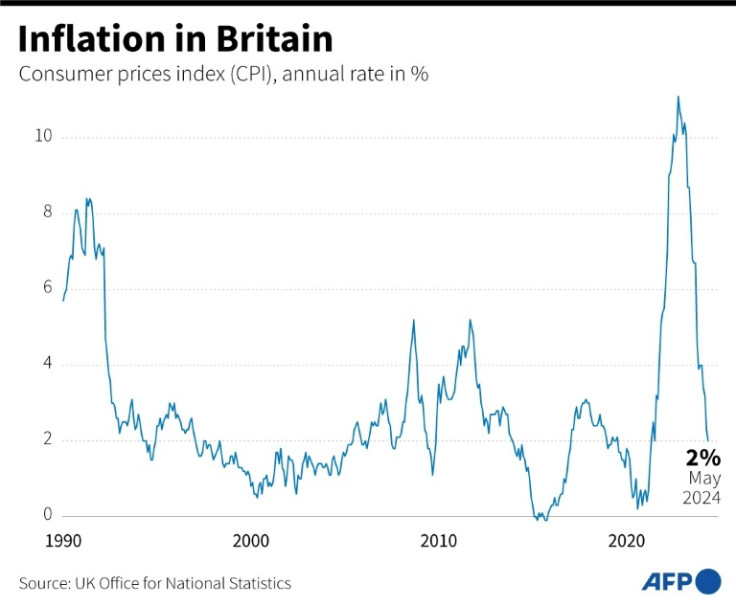

The Consumer Prices Index decelerated to 2.0 percent in May from 2.3 percent in April, the Office for National Statistics said in a statement citing easing growth in food prices.

UK inflation last stood at the Bank of England's 2.0-percent target in July 2021, before rocketing higher in a cost-of-living crisis fuelled largely by soaring energy and food bills.

The BoE will announce its latest monetary policy decision on Thursday but is expected to stand pat on interest rates, as is customary so close to a UK general election.

Irrespective of the election, analysts added that the central bank would likely hold fire with prices still rising on top of sharp increases seen in recent years.

It comes as shoppers remain plagued by shrinkflation where companies slash the size of products yet charge the same or even more.

Wednesday's data was unlikely to move the dial on Sunak's struggling election campaign in the runup to the July 4 vote, analysts remarked.

"Today's inflation data will be no doubt welcomed by Sunak, who will use this as evidence that the Tory plan on the economy is working as we approach July's election," noted Matthew Ryan, head of market strategy at global financial services firm Ebury.

"Whether the news will make any real difference appears unlikely, with the Conservatives appearing on course for their worst election performance since the party was founded in the 1830s."

The main opposition Labour has consistently led Sunak's Conservatives by around 20 points in opinion polls for nearly two years, suggesting its leader Keir Starmer will become the next prime minister.

May's inflation slowdown "will no doubt cause delight within the Conservative Party... not that current polling suggests the outcome of the election on 4 July can be materially different than a large Labour victory", noted Nomura economist George Buckley in a research note.

Sunak hailed the inflation slowdown, but Labour slammed the Conservatives' stewardship of the economy after 14 years in power.

"It's very good news, because the last few years have been really tough for everybody," Sunak told LBC radio.

"Inflation is back to target, and that means people will start to feel the benefits and ease some of the burdens on the cost of living, and it's because of that economic stability that we've restored."

After peaking at 11.1 percent in October 2022, consumer price growth has cooled following a series of interest-rate hikes by the UK central bank.

Britain's economy, however, stagnated in April after emerging from recession in the first quarter of the year, data showed last week, as businesses and households weathered the cost-of-living crunch.

"After 14 years of economic chaos under the Conservatives, working people are worse off," Labour's finance spokesperson Rachel Reeves said Wednesday.

"Prices have risen in the shops, mortgage bills are higher and taxes are at a 70-year high. Labour has a plan to make people better off bringing stability back to our economy."

The BoE began a series of rate hikes in late 2021 to combat inflation, which rose after countries emerged from Covid lockdowns and accelerated after the invasion of Ukraine by key oil and gas producer Russia.

The institution last month held its main interest rate at a 16-year high of 5.25 percent but hinted at a summer reduction owing to cooler UK inflation.

Elevated interest rates have worsened the cost-of-living squeeze because they increase the cost of borrowing, thereby cutting disposable incomes and crimping economic activity.

"Today's data are unlikely to spur a surprise rate cut tomorrow, however, the (bank) could have sufficient evidence to begin its easing cycle in August," said KPMG UK chief economist Yael Selfin.

© Copyright AFP 2025. All rights reserved.