Yahoo posts gloomy earnings for Q2

Fallen tech giant's shares shed 46 cents a piece

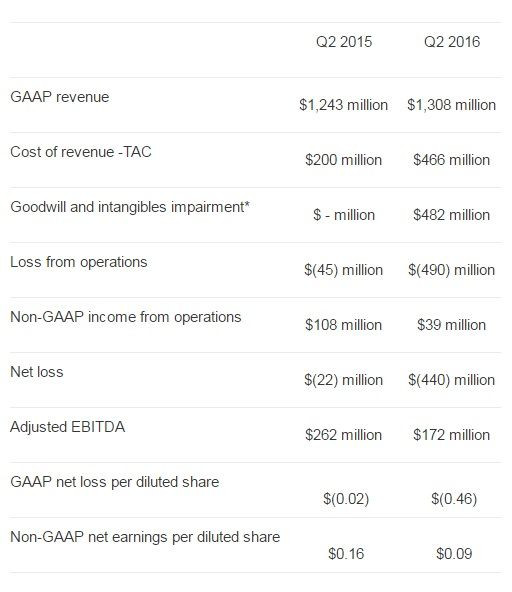

Yahoo (NASDAQ:YHOO) continues to bleed from widening losses despite a measly increase on its traffic-driven revenue. The ailing Internet company posted a whopping 1,900 percent surge in net loss for the second quarter as it registered US$440 million (AU$580 million) net loss compared to the US$22 million (AU$29 million) it has lost on the same period last year. This translates to 46-cent loss per share compared to the 2-cent loss a year ago.

Based on Yahoo’s Q2 Financial Report published Monday in the US, the widening loss is due to the increasing operational loss which cost the company US$490 million (AU$646 million) from $45 million (AU$59 million) last year.

As a consequence, Yahoo’s Q2 revenue rose by only 5 percent to US$1,308 million (AU$1,725 million) from US$1,243 million (AU$1,639 million) a year ago. Revenue from mobile, video, native advertising and social media increased to US$504 million (AU$665 million) from $401 million (AU$529 million), but total traffic-driven revenue slightly rose to 11 percent from US$1,253 (AU$1,653 million) million from last year’s $1,124 million (AU$1,483 million).

With the company’s gloomy earnings report, Yahoo shares fell 1 percent in after-hours trading to US$37.59 (AU$49.58).

Making 'solid' progress

Nevertheless, Yahoo Chief executive Marissa Mayer said, “with the lowest cost structure and headcount in a decade, we continue to make solid progress against our 2016 plan.” To recall, Yahoo laid off 15 percent of its workforce in February as a cost-cutting measure.

“Through disciplined expense management and focused execution, we delivered Q2 results that met guidance across the board and in some areas exceeded it,” she added.

Despite Monday’s deadline for bid submissions, Mayer offered no update on the company’s ongoing sale of its core business.

The fallen tech giant is expecting to review a final round of bids from suitors of its web properties, which up to now remains difficult to value. But analysts’ estimates range from US$3 billion (AU$3,957 million) to US$4 billion (AU$5,276 million). Potential bidders include Verizon Communications, private-equity firm TPG, and Quicken Loans founder Dan Gilbert.