The real reason behind Samsung’s falling profits is Xiaomi and not Apple.

Pavithra Rathinavel Dec 18, 2014

Japan's north-eastern Fukushima prefecture wants to host some of the preliminary events for the 2020 Tokyo Olympics.

Esther Tanquintic-Misa Dec 17, 2014

The Australian share market has ended a 6 session losing streak on Thursday with a gain of 9.6 points. The ASX 200 trade through a range of 41 points from low to high. The market was down 2 points at its worst levels and up 39 points at its best.

Vittorio Hernandez Dec 17, 2014

Robin Williams was the most searched topic in Google Canada for the year 2014.

Esther Tanquintic-Misa Dec 17, 2014

Being a millennial is not all about how old you are.

Vanessa Doctor Dec 17, 2014

Buyers have made a rare impression on the ASX 200 in early trade on Wednesday. After 6 consecutive sessions of losses the share market has spent the morning in positive territory, having opened with a small loss of 2 points, before moving on to a gain of 33 points at session highs. As lunchtime approached the ASX 200 was ahead by 32 points.

Vittorio Hernandez Dec 17, 2014

So you found yourself in debt -- it's not the end of world yet

Vanessa Doctor Dec 17, 2014

Russian Ruble fluctuation has caused Apple to shut its online store specific to Russian market.

Pavithra Rathinavel Dec 17, 2014

Very high oil prices may be bad for the global economy, but too low prices of the commodity may also negatively impact markets.

Sachin Trivedi Dec 17, 2014

Gartner’s Q3 market share report has been published.

Pavithra Rathinavel Dec 17, 2014

The Australian Dollar is unchanged from this time yesterday, having given back some overnight gains as volatility increases in global markets.

Vittorio Hernandez Dec 17, 2014

It's the end of the year, a busy season for doomsayers and hoaxers. This explains why everyone is talking either about World War 3 to be initiated by Russia or writing hoax articles.

Vittorio Hernandez Dec 17, 2014

Equities rebounded in European trade whilst US equities struggled as investors exercised caution heading into the FOMC meeting. Additionally, oil prices remained extremely volatile, with weakness prevailing. In Europe, traders focused on surprisingly firmer manufacturing and services PMIs, along with a vast improvement in the ZEW economic sentiment readings.

Vittorio Hernandez Dec 17, 2014

In US economic data, housing starts fell by 1.6% in November to a 1.028 million unit pace. Building permits fell by 5.2% in November. Despite the mild pullback the housing sector continues to see healthy improvement. The Markit Flash PMI eased from 54.8 to 53.7 in December - a 11 month low. A reading above 50 still signalled an expansion in activity. Across the sub-indices output and employment expanded at a slower pace.

Vittorio Hernandez Dec 17, 2014

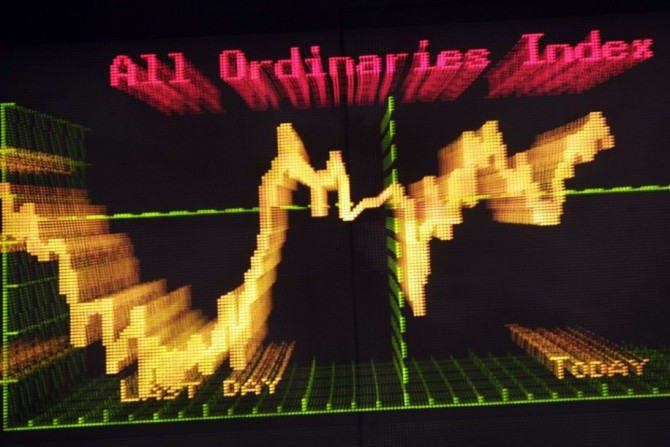

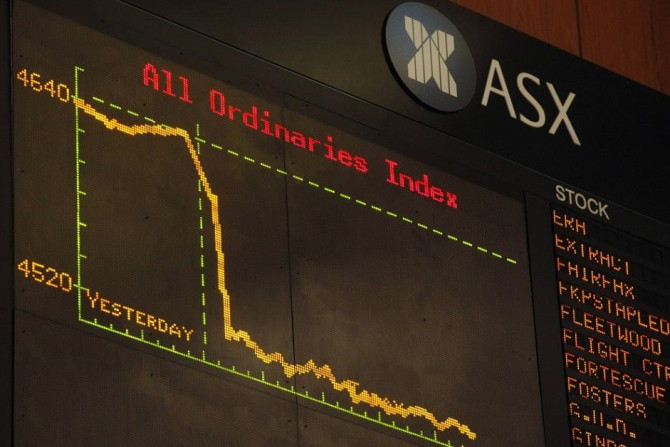

Losses worsened this afternoon with Australian shares falling by 0.7 per cent and closing at a fresh two-month lows in the process. The ASX 200 Index lost 0.7 per cent with both mining and energy industries slumping by around 2 per cent.

Vittorio Hernandez Dec 16, 2014

Australian shares are falling for the sixth straight session and trading at two month lows. The ASX 200 Index is down 0.5 per cent with the energy and mining sectors continuing to be the main liabilities.

Vittorio Hernandez Dec 16, 2014

Sony hackers released another instalment of leaked documents.

Sounak Mukhopadhyay Dec 16, 2014

Australia has traditionally been dependent on the mining industry and falling iron ore prices may affect the budget.

Sachin Trivedi Dec 16, 2014

The Sydney siege ends in tragic circumstances in the early hours of this morning with a sad loss of life for some innocent people. Market moves in Australia remain dominated by global events.

Vittorio Hernandez Dec 16, 2014

Equities tapered off in the US and tracked weakness seen in Asian and European trade. Turmoil in the energy space continued to cloud positive developments on the US economic data front.

Vittorio Hernandez Dec 16, 2014

In US economic data, industrial production rose by 1.3% in November after advancing by 0.1% in October - marking the largest rise since May 2010. Capacity utilisation rose from 79.3 to 80.1 - the highest reading since March. The New York Fed Empire State index fell from +10.16 to -3.58 in December - the first negative result in almost a year. US NAHB Housing Market Index eased from 58 to 57 in December - highlighting that home builder sentiment remained relatively optimistic.

Vittorio Hernandez Dec 16, 2014

The strength of New Zealand property market is that it has no restrictive policy that may repel foreign buyers.

Kalyan Kumar Dec 16, 2014

Tesco Direct, a website selling Playstation games, has hinted at a July 31, 2015 release for the "Uncharted 4: A Thief's End"; game series.

Vincent Paul Hidalgo Dec 15, 2014

Australian shares at 2.30pm AEDT are down by 0.6 per cent; adding to last week's 2.2 per cent slump. Although most sectors are losing ground the telcos, IT stocks, utilities and healthcare industries are modestly firmer. Mining companies are faring worst; with BHP Billiton (BHP) down 1 per cent and Rio Tinto (RIO) is down 1.1 per cent.

Vittorio Hernandez Dec 15, 2014

Apple Inc (AAPL) stock is expected to continue soaring high in 2015 with strong iPhone 6 sales and the launch of the Apple Watch.

Reissa Su Dec 15, 2014

The drop in oil prices in the past few months has raised concerns about the consequence of prolonged low prices of the commodity.

Sachin Trivedi Dec 15, 2014

The Australian Dollar has opened trading this morning in the mid .8200's after another day of weaker commodity and equity markets on Friday.

Vittorio Hernandez Dec 15, 2014

Global equities extended their slide on Friday, with investors continuing to focus on the slump in oil prices. Oil remained at levels not seen since mid-2009 with WTI remaining below $60 per barrel. Apart from China, which benefited from some surprisingly solid data, the rest of the globe struggled on Friday. Retail sales and fixed asset investment were mildly better than expected, but industrial production fell short presumably due to factory closures ahead of the APEC summit.

Vittorio Hernandez Dec 15, 2014

Based on the movement of iron ore prices in the global market, mining giant BHP Billiton (ASX: BHP) forecast that the price of this key-steelmaking ingredient would not breach $100 per tonne.

Vittorio Hernandez Dec 15, 2014

In US economic data, consumer sentiment rose from 88.8 to 93.8 in December - a near eight-year high. The survey's barometer of current economic conditions rose from 102.7 to 105.7 - highest level since February 2007. The survey's one-year inflation expectation rose from 2.8% to 2.9%.

Vittorio Hernandez Dec 15, 2014