Australian shares improved for the fourth time this week, taking the gains for the five days to 2.65 per cent. The All Ordinaries Index (XAO) rose by 0.55 per cent today with no sectors missing out on the gains.

Australia's fertility rate has declined to its lowest in 10 years. Low confidence in the economy may be holding back people from investing in family.

Jennifer Lawrence bought a new property.

Australian shares are rising for the eighth time in nine sessions and have completely made up for yesterday's pullback. The All Ordinaries Index (XAO) is up 0.3 per cent or 19pts to 5388. If the gains are maintained this afternoon this will be the best week for local shares since mid-February.

Medical historian Dr. Howard Markel of the University of Michigan said this won't be the first time health practitioners will refuse patients afflicted with a deadly virus as like that of the Ebola.

Edward Baptist's book pointing out that slavery was the foundation of US economic development lures a lot of interest.

The LG G Watch R will be available for purchase in European countries, North America, Asia and others through retail sites and Play Store in November.

Retail sector throws up sudden twists as new format stores can upset any well run chain.

Individuals designated as suicide bombers by the ISIS are first drugged so they can perform the supposed act of martyrdom.

Equities bounced back strongly in a move triggered by a round of PMI prints from China and the eurozone. This eased some of the global growth concerns that had escalated recently and the gains managed to extend through US trade as earnings continued to impress. Results from Caterpillar, Microsoft and 3M were all strong, but Amazon didn't do particularly well after-market. Caterpillar is generally considered a bellwether for growth and while it's encouraging to see the company perform well,...

The 1-minute, 56-second advert by Australian model Miranda Kerr surely sold thousands of EasyTone sneakers for athletic shoe brand Reebok. However, an Australian Federal Court declared on Tuesday that the commercial made false claims that the shoe was better for calves, thighs and buttocks of its user.

US economic data, jobless claims rose by 17,000 to 283,000 last week. US markit "flash" manufacturing fell by 57.5 to 56.2 October. Across the sub-indices, new orders growth eased markedly, with new export sales falling sharply. US FHFA home prices rose 0.5% in August to be up 4.8% over the year. The US leading indicators index rose by 0.8% in September - pointing to solid growth economic for the rest of the year.

The WHO targets to release an Ebola blood serum within two weeks.

Canadian biopharmaceuticals firm Tekmira has started manufacturing in small numbers its TKM-Ebola drug.

Canadians are warned to take necessary precautions when travelling to the Caribbean region.

Travellers to the U.S. from Liberia, Sierra Leone and Guinea are mandated to pass at five designated airports before being allowed entry into the country.

Australian shares are treading water ahead of an update on China's manufacturing sector at 12.45pm AEDT. The All Ordinaries Index (XAO) is down 0.1 per cent, losing ground for the first time in almost two weeks.

Growth prospects in the developed countries as well as some emerging markets look promising.

This calls for raising the bar on car safety both by manufacturers and regulators.

The US markets snapped out of a four day losing streak overnight. The futures market Asia will likely follow suit, while the ASX should snap out of a seven day rally.

Fresh from its New York initial public offering (IPO) that raised a record $25 billion fresh capital, Chinese e-commerce giant Alibaba (NYSE: BABA) has partnered with an Australian software company. Its team up with Bigcommerce is expected to further rival its US competitor Amazon.

Prime Minister Tony Abbott may have won votes when as Opposition leader he promised to repeal the carbon tax pushed by then PM Julia Gillard. While he succeeded in repealing the measure after the coalition got the majority in the September 2013 federal election, Aussie voters now appear to get the short end of his electoral promise.

US economic data, the Consumer Price Index rose by 0.1% in September while the core index (excludes food and energy) also rose by 0.1%. Prices are up 1.7% on a year ago. The mortgage market index soared by 11.6% with the refinancing index up 23.3% in the latest week.

The feature of the second half of Wednesday's trade was the ASX 200 recovering from a flat spot in late morning trade to make new session highs over the afternoon. The gains of the day were the best improvement of the current winning streak which has lasted for seven sessions.

The positive tone for the Australian share market has extended into Wednesday following solid gains for Wall St overnight. US stocks recorded strong gains on Tuesday supported by healthy corporate results. The S&P 500 has now gained more than 6% since its session low last Wednesday. In Europe stock indices rose on speculation that the European Central Bank is considering buying corporate bonds to revive the region's economy. Reports suggested a plan could be approved by December and start ear...

'Volatility is a natural part of markets, whereas highly accommodative monetary policy is not.' This was my statement on Monday about the effect of monetary policies on markets - it acts as a volatility depressor.

After releasing a better-than-expected Q4 FY2014 earnings, Apple stock is expected to reach the three-digit territory.

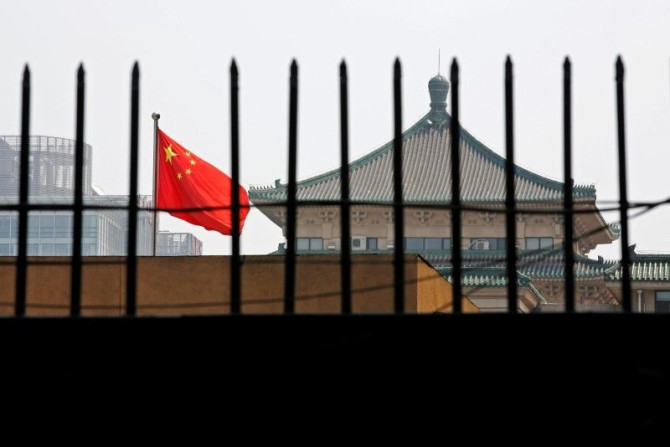

Australian Treasurer Joe Hockey said on Tuesday that there is a chance that China would waive its newly imposed coal tariff if Canberra and Beijing would soon ink a free trade agreement.

Australian shares faded this afternoon to end a touch lower for the first time in six days. The All Ordinaries Index (XAO) fell by 0.1 per cent following the 0.9 per cent improvement on Monday. Better than expected Chinese economic news initially boosted markets and currencies at 1pm AEDT.

It is quite expensive to block pirate websites like The Pirate Bay.