Could OQtima Be The Top Forex Broker Of 2024? A Detailed Review

OQtima has rapidly established itself as a prominent player in the forex brokerage industry. This growth can be attributed significantly to the seasoned professionals who steer the company. These industry veterans hail from reputable firms such as IC Markets, TMGM, FxPro, and FP Markets, bringing with them a wealth of knowledge and expertise that fuels OQtima's operational strategies and innovation.

The collaboration with Gianluigi Buffon, an iconic figure in sports, marks a significant milestone for OQtima. This alliance not only boosts the company's visibility globally but also aligns it with excellence and a winning mentality. Buffon's partnership goes beyond mere celebrity endorsement; it is a strategic move to inject OQtima with a spirit of reliability and top-tier performance, akin to the legendary goalkeeper's own career.

This strategic partnership and the strong foundation provided by its leadership are central to OQtima's ability to offer accessible yet comprehensive trading solutions. These elements combine to make OQtima a preferred choice for traders looking for reliable and dynamic trading platforms. The company's commitment to transparency and integrity in operations further cements its status as a trustworthy partner in the forex trading sector.

OQtima Key Features

OQtima offers a range of standout features designed to optimize the trading experience:

- Rapid Execution: Trades are executed in less than 30 milliseconds, ensuring fast and efficient market entry and exit.

- High Leverage Options: Provides up to 1:1000 leverage, giving traders significant potential to magnify their returns.

- Competitive Spreads: Starting at 0.0 pips, these low spreads help reduce trading costs and improve profit potential.

- Extensive Product Portfolio: Access over 1000 tradable products, allowing diverse investment opportunities across multiple markets.

- Safety Measures: Features such as Negative Balance Protection safeguard traders from losing more than their account balance.

- Cost Efficiency: No fees charged on deposits or withdrawals, enhancing the overall value for traders.

Building on these powerful features, let's explore further into the specific services and trading conditions that distinguish OQtima in the forex market.

Trading Platforms Offered by OQtima

OQtima provides access to three of the industry's leading trading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. Each platform is engineered to suit different trading styles and preferences, offering unique advantages.

MetaTrader 4 (MT4): Renowned for its user-friendly interface, MT4 is ideal for both beginners and experienced traders. It supports numerous currencies and tools, includes automated trading through expert advisors (EAs), and offers advanced charting capabilities. MT4's robustness and reliability make it a top choice for forex trading.

MetaTrader 5 (MT5): As the successor to MT4, MT5 provides enhanced features including more charting tools, better order management systems, and supports more trading instruments. Importantly, MT5 is designed to accommodate more advanced trading operations and comprehensive price analysis.

cTrader: Known for its sleek interface and advanced technical analysis tools, cTrader is particularly favored by experienced traders. It offers superior order execution speeds and greater charting flexibility. Unique features such as Level II pricing and detachable charts provide a powerful trading experience focused on precision and flexibility.

OQtima Account Types

OQtima caters to a diverse range of traders by offering two primary account types: the OQtima ECN+ and the OQtima ONE. Each account is tailored to different trading strategies and experience levels, ensuring that all traders can find a match for their needs.

OQtima ECN+ Account: This account type is designed for advanced traders who prefer a dynamic trading environment. It offers spreads starting from 0.0 pips and a commission of $3.00 per traded side. The ECN+ account provides access to over 1000 tradable products and supports high leverage options up to 1:1000 for international traders. A minimum deposit of $100 is required for international traders, while European traders need to start with at least $200.

OQtima ONE Account: Perfect for beginners and those who prefer cost-effective trading, the OQtima ONE account eliminates trading commissions and offers spreads starting from 1.0 pip. Similar to the ECN+ account, it allows trading in a wide range of products and also supports leverage up to 1:1000 internationally and 1:30 in Europe, with the same minimum deposit requirements.

Both accounts offer multiple base currency options including EUR, USD, GBP, CHF, CAD, JPY, SGD, and ZAR, enabling traders from various countries to manage their funds efficiently and avoid conversion fees. This flexibility, combined with competitive account features, ensures that OQtima can meet the needs of traders worldwide.

What Can You Trade With OQtima?

OQtima offers an expansive array of trading options that cater to a wide spectrum of investors, ranging from novices to seasoned traders. The diversity in its product offerings ensures that there are opportunities for every investment style and risk tolerance level.

Forex: Traders can explore the global currency markets with over 80 currency pairs at OQtima, including 7 major pairs, 21 minor pairs, and more than 52 exotic pairs. This extensive range allows traders to capitalize on price movements in different economies.

Indices: For those interested in broader market trends, OQtima provides the ability to trade 20 of the world's leading indices. This selection includes benchmarks from across major economies, offering a comprehensive view of the global markets.

Metals: Investors looking to hedge against inflation or speculate on commodity prices can trade the most important metals such as gold, silver, and platinum.

Cryptocurrencies: In response to the growing demand for digital currency trading, available just for international traders, OQtima offers CFDs on 45 cryptocurrencies, for including major names like Bitcoin and Ethereum. This allows traders to engage with this volatile market without needing to own the actual cryptocurrencies.

ETFs and Shares: Additionally, OQtima's platform features trading on 100 ETFs and 91 renowned global shares, from technology giants to traditional industrial firms.

The vast selection of tradable products at OQtima not only provides ample trading opportunities but also allows investors to diversify their portfolios extensively, potentially reducing risk and enhancing returns through a variety of market conditions.

OQtima Regulatory Compliance and Security

OQtima prides itself on strict adherence to regulatory standards, operating under the oversight of two major financial authorities: the Financial Services Authority (FSA) and the Cyprus Securities and Exchange Commission (CySEC). These regulations ensure that OQtima maintains the highest levels of operational integrity and trader security.

FSA Regulation, Licence Number SD109: Under FSA guidelines, OQtima offers leverage up to 1:1000, catering to international traders looking for high-risk, high-reward opportunities. The FSA's rigorous oversight ensures that all trading operations are conducted with transparency and fairness.

CySEC Regulation, Licence Number 406/21: For traders within Europe, OQtima operates under CySEC's jurisdiction, which restricts leverage to 1:30 in accordance with European financial laws. This lower leverage limit helps protect retail investors from the significant risks associated with high leverage trading.

Safety Features

- Segregated Funds: OQtima enhances trader confidence by maintaining client funds in segregated accounts, ensuring that traders' capital is not used for any operational expenses or corporate uses.

- Negative Balance Protection: This safety feature is crucial in safeguarding clients from losing more money than they have deposited, protecting them against unexpected market volatility and adverse trading conditions.

Additionally, OQtima conducts periodic audits both internally and through independent external auditors to further ensure compliance and security. These comprehensive measures are fundamental to maintaining OQtima's reputation as a reliable and secure platform in the forex trading industry.

Customer Service

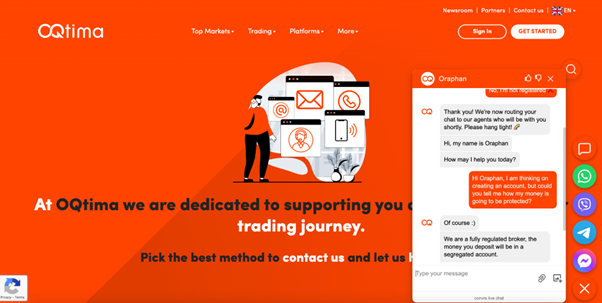

OQtima is committed to providing exceptional customer support, ensuring that clients receive timely and effective assistance across various platforms. The customer service team can be reached through several channels:

- Email Support: Clients can send their queries to support@oqtima.com, which is monitored 24/7 for prompt responses.

- Phone Support: For immediate assistance, customers can call +44 2045867126, where trained representatives handle inquiries efficiently.

- Live Chat: Available directly on the OQtima website, this service offers real-time problem-solving solutions from knowledgeable staff.

- FAQs: A comprehensive FAQ section is also available, covering a wide range of topics to help users find quick answers to common questions.

These diverse contact options ensure that OQtima's clients can resolve their issues and get back to trading as quickly as possible, enhancing the overall user experience by providing reliable, accessible support.

Conclusion

Throughout this review, we've covered the extensive features and services provided by OQtima, including its robust trading platforms (MT4, MT5, and cTrader), diverse account options, and a wide range of tradable products. Key security measures like Negative Balance Protection and Segregated Funds Account underscore its commitment to trader safety, while competitive spreads and zero deposit or withdrawal fees enhance its market appeal.

OQtima stands out as a top choice for traders globally due to its adherence to stringent regulatory standards, comprehensive trading tools, and responsive customer support. OQtima offers a reliable and enriched trading environment that caters to both novice and experienced traders, making it a worthy consideration for your trading needs.

© Copyright 2025 IBTimes AU. All rights reserved.