After a solid night on European and US markets, the Australian market opened higher this morning. But not by as much as the SPI futures index had expected. The All Ordinaries Index added 12points at the start of trade rose to an 20 point gain but by lunch the market fell away and was down 11pts

European shares rose on Monday. Shares in Citigroup rose after releasing solid earnings figures. And fears about the health of the Portuguese banking system continued to ease. The FTSEurofirst 300 index rose by 0.8% with the German Dax higher by 1.2% while the UK FTSE gained 0.8%. Australia´s major miners were higher in London trade with shares in BHP Billiton up by 1.6% while Rio Tinto lifted by 1.2%.

The Australian market closed the first day of the trading week on a high, with the All Ordinaries opened up 16pts higher at the beginning of the session and by the close the markets had added 21.2pts and the ASX 200 up 24.6pts to 5,511.4pts.

The Australian market started the week's trade in positive territory after the US and European markets closed higher on Friday.

The All Ordinaries opened up 16pts higher at the beginning of the session and by lunchtime the markets had added 28.6pts to 5,503pts.

The final phase of an operation to salvage Italy's ill-fated cruise ship Costa Concordia has began on Monday, two and a half years after it sank off the island of Giglio, claiming 32 lives in the process.

Now it can be told. Seems German Pope Emeritus Benedict XVI's prayers worked better than Argentinean Pope Francis. And sourgraping Brazil is very much elated that archrival Argentina didn't win the coveted World Cup 2014 title.

Financial stress in Europe has seen the US market log its worst week in four months.

In US economic data the Federal Budget was in surplus by US$71 billion in June, below forecasts of an US$80 billion surplus. The weekly Economic Cycle Research Institute Leading index was up 4.4% on a year ago, up from 4.3% in the previous week.

French police on Thursday said it had intercepted a terrorists' plot to blow-up the famous romantic monument Eiffel Tower, the Louvre as well as a nuclear plant in France last summer.

Despite a softer start to trade this morning, the Australian sharemarket has steadily improved in the lead-up to lunch. The All Ordinaries Index (XAO) is up 0.5 per cent, is improving for the second day and has defied the weak lead from Wall Street overnight.

Japan's capital of Tokyo is now on high alert in anticipation of Typhoon Neoguri which is expected to reach areas near the tsunami-crippled Fukushima nuclear power plant on Friday.

In US economic data new claims for unemployment insurance (jobless claims) fell by 11,000 to 304,000 in the latest week. Wholesale sales rose by 0.7% in May, in line with forecasts, while inventories rose by 0.5%.

After a solid night in US Aussie market lifted from the open of trade and by the close ended higher. The All ordinaries Index added 12.1points to 5454.3 points with most sectors closing higher.

After a solid rebound in the US overnight - helped by positive commentary from the Federal Reserve the Aussie market has opened higher before falling back at noon. After the Federal Reserve stated in its minutes from the last FOMC meeting, that it plans to end its current stimulus program in October 2014. The Dow Jones up nearly 80pts and the NASDAQ up just under 30pts.

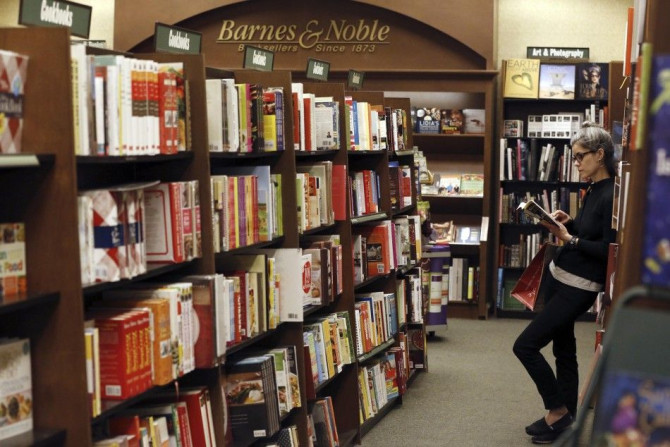

There is no clear investor-education authority insofar as investor education is concerned, a new survey by the CFA Institute showed. Among seven information sources listed in the poll, books, magazines and online media emerged as the top choice, garnering 37 per cent of the responses.

Sellers continued to make an impression on the local share market on Wednesday. At the best levels of the day the ASX 200 was down by 10 points; at the lows of the session the index had shed 71 points; at the closing bell the market was down 58 points or a shade over 1%. In broader term the market remains above the 5400 mark at 5452.0. This point is worth keeping in mind. It was only several weeks ago that the market was having a lot of trouble sustaining itself in the area below 5400 for the in...

The Australian sharemarket is losing ground for the third consecutive day, following the worst session in a fortnight for U.S. markets. The All Ordinaries Index (XAO) is down 0.9 per cent; the biggest daily slide in over a week.

Fundamentals are the new reasoning for caution as commentators are pointing to overvaluations, astronomical multiple expansion and the earnings unable to match price.

In US economic data, consumer credit rose by $19.6 billion in May - in line with expectations. US Minneapolis Fed President Kocherlakota (voter, dove) spoke overnight, saying that the improvement in the unemployment rate overstates the degree of healing in the labour market. In addition he stated that it was more likely inflation would come in below the Fed´s 2% target over the next year than above it.

The ASX 200 traded in a range of 20 points over the course of Tuesday. In the first hour of trade the ASX 200 was at its best and worst levels when it was up by 1p and down by 19 points. There after the index battled to move higher;on several occasions it tried to surmount the 5515 level where it failed on the 3rd occasion, before ending at with a loss of 8 points at 5510.

The Australian sharemarket is falling for the second day, with sluggish performances offshore last night not helping. The All Ordinaries Index is down 0.1 per cent and is flirting with the key 5500pt mark.

The Japan Meteorological Agency has issued what could be its highest alert to warn residents of Okinawa and the rest of the country to relocate to higher grounds in anticipation of massive wind damages and localized flooding brought by super typhoon Neoguri.

At least three people have died, among them a newborn boy, after a strong 6.9-magnitude shook the border between Guatemala and Mexico on Monday. The temblor injured 32 others, damaged dozens of buildings, toppled down power lines as well as triggered landslides.

It's been 109 trading days since the S&P futures has had a pull-back of 5% or more and on current trend, is it unlikely abate anytime soon.

It was an uneventful start to the trading week, with the Australian market closing largely flat. The All Ordinaries index (XAO) eased by just 0.1 per cent or 5.5pts while still remaining above the key 5500pt level. The Independence Day holiday in the U.S. on Friday and the subsequent closure of American markets provided local stocks no lead today.

The Australian sharemarket is off to a quiet start following a holiday in the U.S on Friday. The All Ordinaries Index (XAO) is down by just a few points with weakness from the miners, energy stocks, industrials and healthcare sector the biggest drags.

Crews of power supply utility firms on Monday are racing to restore electricity to more than 250,000 homes and businesses groping in the dark in Atlantic Canada after tropical storm Arthur lashed through the area on Saturday morning.

With US markets having been closed on Friday, there are very limited leads for the region to work off this morning. Risk currencies have gotten off to a relatively flat start to the week, which is a firm indicator that nothing much has changed sentiment-wise as of Friday. Perhaps something to focus on is the weakness we saw in European trade after a disappointing German factory orders reading. This saw the major European bourses lose ground, apart from the FTSE which was relatively flat for the ...

US financial markets were closed on Friday for Independence Day.

Mining giant BHP Billiton (ASX: BHP) said the 31 per cent drop in the price of iron ore in the international market may not be the last. It anticipated further declines in the price of the key steel-making ingredient in the coming months, said BHP Billiton President of Marketing Mike Henry.