In the US, the ISM services index fell from 58.6 to 57.1 in October, short of estimates near 58.0. The ADP survey of private employment showed that 230,000 jobs were created in October, above estimates near 220,000. And weekly home loan commitments fell 2.6% in the latest week with new purchases up 2.6% while refinancing fell 5.5%.

November is always a dull month in the world of trading. US earnings season has passed, investors start to think about the new year and most macro influences slow down to a trickle.

In the US, durable goods orders fell by 1.1% in September with factory orders down by 0.6%, in line with forecasts. The trade deficit widened from US$40.1 billion to US$43.03 billion in September (forecast US$40 billion). The ISM New York index rose from 654.8 to 657.2 in October. And chain store sales were up 3.9% on a year ago in the latest week, down from 4.4% in the previous week.

The Australian sharemarket has ended the session firmer, after trading fairly flat for most of the day. Volumes were light with Victoria celebrating the Melbourne Cup public holiday. The S&P/ASX 200 climbed 13pts or 0.20 per cent to 5,519.

After a modest setback on Monday, the Australian share market has spent the early part of Melbourne Cup day 2014 moving higher in a restrained fashion. The flat start for the local market was a reasonable result in the face of weaker equity markets in the US and Europe. US investors were encouraged by figures showing the US ISM manufacturing index rose from 56.6 to 59.0 in October, above forecasts for a result near 56.2. European shares fell on Monday with investors disappointed by purchasing ma...

Global markets were mixed, with a predominantly risk off tone driven by a disappointing manufacturing PMI print out of China. Fed member Fisher was also on the wires suggesting he is concerned the Fed will be too late to raise rates and he was not too worried about a slight undershoot in inflation. This, along with slightly better US manufacturing data, contributed to the downward bias in equities. Europe was the hardest hit as peripheral bond yields rose, sending EUR/USD below $1.2500. This saw...

In the US, the ISM manufacturing index rose from 56.6 to 59.0 in October, above forecasts for a result near 56.2. Construction spending fell by 0.4% in September, whereas economists had tipped a 0.7% gain. And the six largest automakers in the US have reported October sales that were up 6% on a year ago.

The Australian sharemarket has ended the session near the day's lows. The All Ordinaries Index (XAO) slipped 20pts or 0.3 per cent to 5,485. Consumer Staples were the worst performing sector dropping 1.94 per cent. Volume 1.68 billion shares traded worth $4.2 billion. 359 stocks finishes firmer, 579 ended lower and 360 closed unchanged.

The Local share market has started the new trading week in a lethargic fashion with buyers and sellers scarcely making an impression one way or the other in early trade on Monday. The lack of commitment from local participants came despite resounding gains in the US at the end of last week. US share markets rose sharply on Friday with the Dow Jones and S&P 500 indexes at record highs as investors drew comfort from the Bank of Japan's move to purchase more assets. The Dow Jones rose by 195 poi...

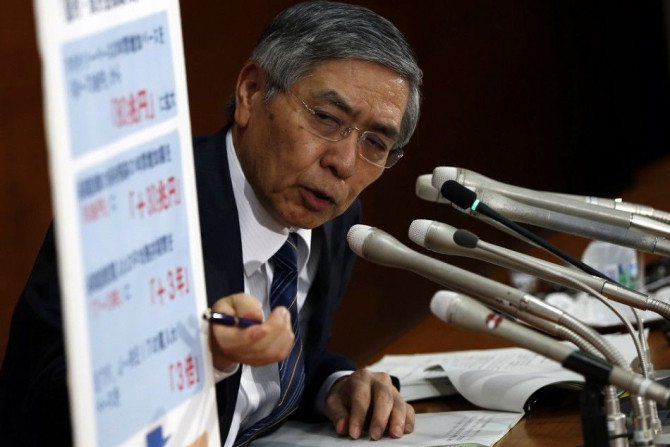

The BoJ took everyone by surprise on Friday. The shock of a ¥30 trillion increase in the pace of long-term government bonds (JBG's) and major portfolio rebalancing from the Government Pension Investment Fund (GPIF) has added a new dimension to the global currency wars.

An HSBC report confirmed previous speculations that Australia would dislodge Qatar as the world's biggest liquefied natural gas (LNG) exporter in 2018. Its major markets would be mainly Asian nations, particularly China, Japan, Korea, Taiwan and India.

In the US, personal income rose by 0.2% in September with spending down by 0.2%. Both results were slightly weaker than expected. The final reading on consumer sentiment in October was 86.9, up from 84.6 and at a 7-year high.

Lava from Hawaii's Kilauea volcano is already threatening homes in Pahoa.

Australian shares recovered this afternoon to make up for most of the earlier losses. The ASX 200 Index fell by 0.1 per cent following a 0.8 per cent improvement on Monday.

Australian shares are falling for just the second time in 11 days, with the ASX200 down by 0.4 per cent. Despite wiping out more than half of Monday's improvements, local stock are hanging close to one month highs.

US earnings season continues to deliver as expected - estimates have been low. However, 79.8% of those companies that have reported have beaten earnings per share estimates, and 60.5% have beaten revenue estimates.

In the US, pending home sales rose by 0.3% in September after falling by 1% in August. US building permits were revised higher to a lift of 2.8% in September (previously 1.5%). The Markit "flash" service sector PMI slipped from 58.9 to 57.3 in October - the lowestresult since April.

Monday afternoon provided more encouragement for market optimists with the ASX 200 remaining in the vicinity of session highs over the second half of the day. This fact was impressive for the fact that miners moved back into the red as a group following a recovery earlier in the morning.

Global markets are focusing on Europe this morning as results from the ECB's stress tests were finally released. The results were relatively in line with expectations despite announcing an overall gross capital shortfall of €24.6 billion. This equates to around 0.2% of the region's GDP and was spread across 25 banks. Regardless, the main takeaway was the fact some banks have already embarked in some recapitalisation and this has reduced the shortfall to a mere €9.5 billion (from 13 banks...

Australian shares improved for the fourth time this week, taking the gains for the five days to 2.65 per cent. The All Ordinaries Index (XAO) rose by 0.55 per cent today with no sectors missing out on the gains.

Australian shares are rising for the eighth time in nine sessions and have completely made up for yesterday's pullback. The All Ordinaries Index (XAO) is up 0.3 per cent or 19pts to 5388. If the gains are maintained this afternoon this will be the best week for local shares since mid-February.

Equities bounced back strongly in a move triggered by a round of PMI prints from China and the eurozone. This eased some of the global growth concerns that had escalated recently and the gains managed to extend through US trade as earnings continued to impress. Results from Caterpillar, Microsoft and 3M were all strong, but Amazon didn't do particularly well after-market. Caterpillar is generally considered a bellwether for growth and while it's encouraging to see the company perform well,...

US economic data, jobless claims rose by 17,000 to 283,000 last week. US markit "flash" manufacturing fell by 57.5 to 56.2 October. Across the sub-indices, new orders growth eased markedly, with new export sales falling sharply. US FHFA home prices rose 0.5% in August to be up 4.8% over the year. The US leading indicators index rose by 0.8% in September - pointing to solid growth economic for the rest of the year.

Australian shares are treading water ahead of an update on China's manufacturing sector at 12.45pm AEDT. The All Ordinaries Index (XAO) is down 0.1 per cent, losing ground for the first time in almost two weeks.

The US markets snapped out of a four day losing streak overnight. The futures market Asia will likely follow suit, while the ASX should snap out of a seven day rally.

US economic data, the Consumer Price Index rose by 0.1% in September while the core index (excludes food and energy) also rose by 0.1%. Prices are up 1.7% on a year ago. The mortgage market index soared by 11.6% with the refinancing index up 23.3% in the latest week.

The feature of the second half of Wednesday's trade was the ASX 200 recovering from a flat spot in late morning trade to make new session highs over the afternoon. The gains of the day were the best improvement of the current winning streak which has lasted for seven sessions.

The positive tone for the Australian share market has extended into Wednesday following solid gains for Wall St overnight. US stocks recorded strong gains on Tuesday supported by healthy corporate results. The S&P 500 has now gained more than 6% since its session low last Wednesday. In Europe stock indices rose on speculation that the European Central Bank is considering buying corporate bonds to revive the region's economy. Reports suggested a plan could be approved by December and start ear...

'Volatility is a natural part of markets, whereas highly accommodative monetary policy is not.' This was my statement on Monday about the effect of monetary policies on markets - it acts as a volatility depressor.

Australian Treasurer Joe Hockey said on Tuesday that there is a chance that China would waive its newly imposed coal tariff if Canberra and Beijing would soon ink a free trade agreement.