The Fed can't stay out of the market at the moment. St Louis President Jamie Bullard has done a complete about-face by calling for the Fed to hold off on unwinding the asset purchase program at the end of the month.

In US economic data, the Philadelphia Fed business activity index fell from 22.5 to 20.7 in October. Across the sub-indices new orders and prices paid lifted while employment eased. The NAHB Housing market index fell from 59 to 54 in October - the first decline in five months and suggested moderation in the pace of new construction. US industrial production rose by 1% in September, well above forecasts. Strength in mining and utilities drove the result. US jobless claims fell 23,000 to 264,000 l...

It seems Catholic bishops arent softening their stand yet towards gays.

Having started Wednesday on the front foot, trading higher from the opening bell Australian shares consolidated early gains by finishing off the best levels of the day. The ASX 200 finished the session ahead by 38 points or 0.73%. At the best levels of the day the index was ahead by 46 points. The lows of the Wednesday were seen in opening trade when the market was down by 1 point.

US equities remained choppy as investors juggled various factors, including a raft of key earnings. JP Morgan, Citigroup and Wells Fargo reported, with the dominant theme a pick-up in trading revenue. Earnings were mixed and didn't really give a good picture of what to expect from Q3 earnings. Earnings that enjoyed the biggest positive reaction were Citigroup and Intel. Intel reported after-market and impressed, resulting in a 2.8% rise in its shares.

After hitting record-low iron ore prices in the international market, there are indicators that the market has bottomed out. On late Monday, price of the key steelmaking ingredient went up 4 per cent, logging its largest one-day gain in seven months.

European shares recovered in late trade on Tuesday, after hitting an eight-month low earlier in the session. The better earnings results out of the US and rally in US equities prompted the turnaround. Earlier concerns about euro zone growth weighed on markets. The German ZEW monthly survey of economic sentiment fell for a 10th straight month to minus 3.6, the weakest result in almost two years. The FTSEurofirst 300 index rose by 0.1% while the UK FTSE gained 0.4% and the German Dax lifted by 0.2...

Local shares posted one of their better gains of the year today with the All Ordinaries Index (XAO) rising by 1 per cent or 50.9pts to 5204. Despite the improvement, the market's downtrend remains firmly in place with losses of over 8 per cent recorded since the start of September. The next support level for the ASX 200 is around 5070.0.

US shares slumped overnight in thin holiday trade. The Dow Jones fell by 1.4 per cent while the broader S&P500 dropped by 1.7 per cent. Investors are holding their breath for a barrage of profit results from some of America's biggest banks this week. Citigroup, JP Morgan Chase and Wells Fargo are all scheduled to issue third quarter results tonight.

Gadgets designed specifically to connect computers and smartphones to the Internet may soon be a thing of the past as the technology world moves toward the Internet of Things.

A lack of macro news overnight meant markets were left to their own devices, which led to all sorts of indictors and moving averages being triggered.

Despite the low price of coal in the international market, mining giant BHP Billiton (ASX: BHP) pushed through on Monday with the opening of its $3.4-billion Caval Ridge coal mine in Bowen Basin, Queensland.

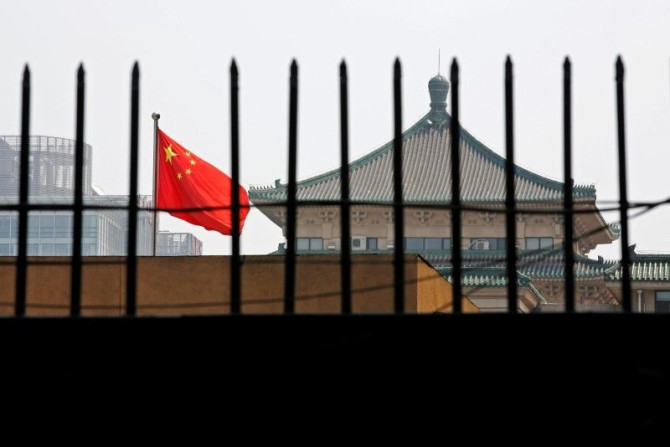

In Chinese economic data released yesterday, the trade surplus narrowed from US$49.83 billion to US$31.0 billion in September with exports up 15.3% on a year ago with imports up 7%.

The Australian market has slumped for the fifth time in six days and remains near an eight-month low. The All Ordinaries (XAO) slipped by 0.6 per cent and local stocks have shed 9.5 per cent from the highs reached at the start of September. The strength in the US dollar and recent concerns of sluggish world growth have been two drivers.

Local shares continue to fall and one of the most common exchanges between market participants at present turns around the level at which the ASX 200 will ultimately find some durable support with the index now down by more than 3 per cent year to date. European shares fell sharply to end last week, driven by continuing concerns about the health of the German, and broader European economy. US share markets were led lower by the technology stocks. Over the course of the week the Dow Jones lost 2....

We have been saying since mid-May to be wary of the events that will occur in October (the end of the asset-purchase program). October remains the turning point of the year and we retain our key pick of being long the VIX.

Local shares extended their losses after lunch, falling for the fourthtime this week and hitting a fresh eight-month low. The All Ordinaries Index (XAO) slumped by 2 per cent, slipping below 5200.0 for the first time since February and making it the worst session of the year.

The local market is taking last night's tumble in the US seriously with Australian shares falling to an eight-month low. The All Ordinaries Index (XAO) is down 1.7 per cent, erasing all of Thursday's gains.

Only the price of iron ore has plummeted to a five-year low, but demand for the key steelmaking ingredient is still high, said mining giant Rio Tinto (ASX: RIO). While the miner expects 125 million tonnes of expensive iron ore supply to leave the market in 2014, Rio anticipates demand for iron ore will remain high as China's steel production would reach about 1 billion tonnes by 2030.

In the US, new claims for unemployment insurance fell by 1,000 in the latest week to 287,000, below forecasts for a result near 294,000. Wholesale sales fell 0.7% in August (forecast +0.7%) while inventories rose by 0.3% (forecast 0.3% gain).

No equity slide is ever linear, nor is a market rally, and I see the development from the central bank communication this week as a chance to break the eight-week down trend in global markets.

Unlike trade on Tuesday the local market maintained its hefty losses for the duration of the session to fall to a fresh eight-month low for the third day. Losses were recorded in all sectors bar the defensive utilities with concerns of Germany's economy together with cuts to world growth forecasts by the IMF concerning some investors.

In times like the present, with volatility ramping and the intraday trading moving through the 100+ point range, I must remind myself that equities are at the top of the risk curve. They're therefore the first to see selling when nervousness is exposed.

In US economic data, the JOLTS index of job openings rose from 4.67 million to a 13-year high of 4.835 million in August. The IBD economic optimism index was unchanged at 45.2 in October. And chain store sales in the latest week were up 5.4% on a year ago, up from the 4.3% annual gain in the previous week.

Australian shares are trading at their weakest levels in eight months, with the All Ordinaries Index (XAO) down 1.3 per cent at lunch. This follows slight falls on Monday in what was a quiet start to a holiday interrupted week. Global markets lost a little ground overnight with the DOW slipping by just 0.1 per cent.

Members of the Association of Southeast Asian Nations (ASEAN) will comprise the ASEAN Economic Community by 2015 in which it aims to act as a single market and production base.

The ECB meeting was the highlight of overnight trade but investors had to wait until President Mario Draghi's press conference for some real direction. After sounding very aggressive and showing willingness to do whatever it takes to spur the economy in past weeks, investors interpreted Mario Draghi's language as less dovish - he failed to say that the committee is ready to adjust the size and composition of purchases. Analysts feel this was a step back from what Draghi's recent comment...

The recovery that stirred the spirits of optimists this morning was fading at lunchtime and not long afterwards the ASX 200 had made a new low for the session. There were no developments in particular that saw the mood shift, and one factor that united the 2 halves of the day was the fact that the majority of sectors remained in the red over the entire session, The ASX200 ending down by 0.7 per cent at 5,298.5 points.

A fat finger caused $617 billion bad orders on Wednesday at the Japanese stock exchange. Fortunately, the amount was cancelled before it was matched, otherwise, it could have caused a disaster in the financial markets because of the huge amount involved.

Germany may not be in the top 10 ranking of the just released Times Higher Education world university rankings, but insofar as students from other countries as concerned, German universities are number 1 if only because the country is 100 per cent tuition-free.