In the US, industrial production fell by 0.1% in October, short of forecasts tipping a 0.2% gain. The New York Fed manufacturing index rose from +6.17 to +10.16 in November.

Because of the huge demand for shares of Medibank Private, the state-owned health insurer could possible raise A$4.8 billion in fresh capital and become the biggest listing in Asia over the past 24 months.

The Chinese president approved the free-trade agreement with Australia and surprised many.

The demand is understandable given that London is the most lucrative international property market.

Australian shares finished in the red for the fifth time in six days with the ASX200 Index slipping by 0.8 per cent. The local market slumped by 1.7 per cent last week and US equities finished mixed on Friday.

Macy’s has a lot of discounts and rebates on various items including bags, shoes, luggage, furniture, appliances, makeup and skin care products starting on Nov. 27, 2014.

X-rays revealed a DHL box labelled as toys actually contained chopped body parts of an infant such as the head, foot and heart. The staff of the global courier company discovered on Saturday the grisly contents as they prepared to ship the box from Bangkok to three Nevada addresses, The Age reports.

There is a general feeling I get from commentary, investors and the market itself that we all want 2014 to finish now, locking in the gains we've seen this year.

The open of trade on Monday saw the ASX 200 go the way it has done for most sessions in recent weeks, down. The low point of the morning saw the index at a deficit of 34 points, although there was no sign buyers were keen to start a new week by taking advantage of lower prices. The weaker bias was informed by the unconvincing outcomes for US and European equity markets at the weekend. US share markets finished mixed on Friday. The Dow Jones was down by 18 points or 0.1% but the S&P 500 index was...

Apple Inc stock continues to do well in the market as it reached another peak at $114. Its record-breaking market capitalisation is higher than the entire stock markets of Russia, Singapore and Italy.

Gina Rinehart is Australia's richest person with an estimated wealth of $22 billion. She would likely hold on to that title for a long time not only because she has rightly invested in coal and iron ore which are still the country's top export earners despite the low price of the two commodity in the international market.

Walmart has a lot of discounts, deals, specials and sales on various items including toys, electronics, appliances, video games, clothes, consoles and other accessories starting on Nov. 27, 2014.

Australian shares are managing to creep into positive territory after a weaker start for the fifth day. The ASX 200 Index (a measure of market performance) is up ~0.1 per cent. A close to 4 per cent slump in the oil price is holding back energy stocks most.

Doctors in New Zealand expressed their disappointment in Air New Zealand's decision to cut regional flights in isolated communities.

The lull in equities continued, with no major catalysts to keep the rally going. There was some downside pressure as oil prices continue to deteriorate and investors digest the prospect of an early rates lift-off. Fed member Dudley was on the wires reaffirming that policy will be tailored to market conditions, essentially confirming that policy is data-dependent.

In the US, new claims for unemployment insurance (jobless claims) rose by 12,000 to 290,000 in the latest week. The Job Opening and Labour Turnover (JOLTS) figures shows job openings fell from a 6-year high of 4.853 million in August to 4.725 million in September, below forecasts centred on 4.823m.

Australian shares closed in the red for the fourth day with the ASX 200 slipping by 0.4 per cent. An improvement from the miners after a 3 per cent slump in just two sessions helped limit the losses.

Keep calm and control your urges during this Black Friday.

Australian shares are sliding for the fourth day taking the losses this week to 1.8 per cent. The ASX 200 index is down 0.4 per cent and is trading below the 5450 mark. It has been a rocky ride for markets in recent months however with local shares surging by 6 per cent over the past month.

Jacob J. Lew is the current U.S. Treasury Secretary. He has held this office since Feb 27, 2013.

Equities continued to consolidate with a mild risk-off tone in a fairly quiet session on the economic calendar. The highlight was perhaps comments by Fed member Charles Plosser who reiterated the Fed should begin raising rates soon in order to avoid being far behind the curve. While Mr Plosser is traditionally a hawk, I think the market is gradually moving in that direction and this perhaps weighed on equities. On the other side of the spectrum, Kocherlakota maintained his dovish stance and said...

A commission has been formed by the Vatican that will handle the sexual abuse appeals lodged by convicted priests.

There are a number of anecdotes as well as jokes on airline meals. Australian flag carrier Qantas hopes to dispel some of those with its offer of Wagyu beef and 50 percent bigger portions on economy seats.

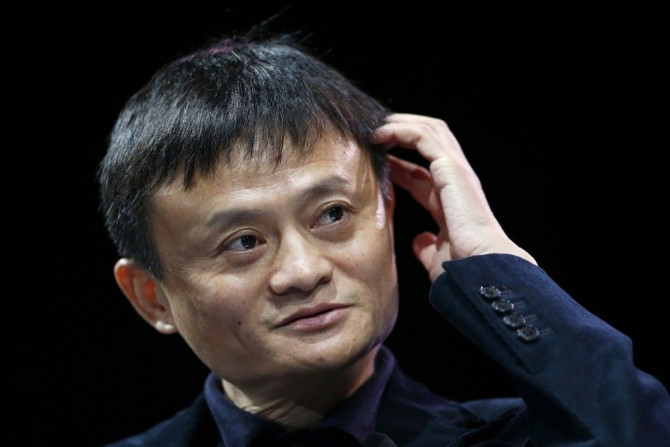

Alibaba founder and former school teacher Jack Ma is today's modern version of the poor little rich man. At 50, he became China's richest person after the Sept 19 initial public offering (IPO) of the e-commerce giant on New York Stock Exchange.

Iron ore prices has fallen to a five-year low of $76 per tonne in the international market. But it isn't the worst case scenario because a Citibank study forecasts the price of this key steelmaking-ingredient could still drop to less than $60 in 2015.

In the US, whole sale inventories rose by 0.3% in September after a 0.6% gain in August - a result that should support the September quarter GDP result.

The Reserve Bank of New Zealand has released its latest financial report with warnings of increased risk to the dairy sector.

Australian shares continued to lose ground over the course of the afternoon on Wednesday. Buying support was scarce in the second half of the session which was reflected in the final result, which saw the ASX 200 end at session lows. At the close of trade the ASX 200 was almost 1% lower or 54 points.

A recent global survey revealed Apple's iPhone 6 has strong demand in China. Sales of iPhone 6 Plus were also notably strong.

Australian shares are falling for the third day with buyers remaining uninspired to enter the market. The ASX 200 index is down 0.6 per cent and is trading below the 5500 pt mark for the first time since last Thursday.