Jack Cooksey is officially the first owner of the Apple iPhone 6 in Australia by lining up all night on Thursday in Perth. However, when he was interviewed by the Today Show, his precious mark in Australian tech history was almost removed because the smartphone dropped to the floor as the nervous gadget owner struggled to open the box.

Vittorio Hernandez

Sep 22, 2014

Chinese e-commerce giant Alibaba Holdings (NYSE: BABA) raised $21.8 billion on Friday when it launched its initial public offering at the New York Stock Exchange. It sold 320.1 million shares at $68, the high end of its revised price range.

Vittorio Hernandez

Sep 22, 2014

A rich American leased the island of Fuga in northern Philippines for 25 years for $2 billion. The 10,000-hectare island-paradise is known for its white-sand beaches and crystal-clear blue water.

Vittorio Hernandez

Sep 22, 2014

There was some evidence of sellers fatigue in early trade on Friday. Buyers were able to get some purchase helped by the fact that ASX 200 has lost 2 per cent so far this week, bringing the losses for the month to 3.5 per cent.

Vittorio Hernandez

Sep 19, 2014

Air Canada's new first checked bag policy rule will come into effect on Sept 18 to bookings and later, for travel on or after Nov 2.

Esther Tanquintic-Misa

Sep 19, 2014

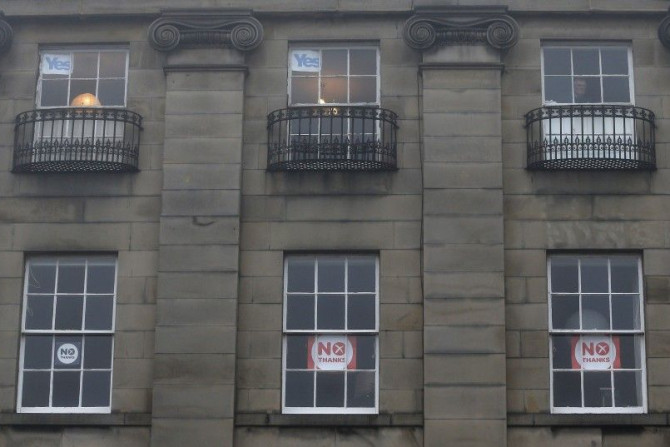

The biggest market volatility events of 2014 are almost over. The FOMC was yesterday, Scotland voting for independence is today and Alibaba, with its mass market interest, is tonight.

Vittorio Hernandez

Sep 19, 2014

In US economic data, jobless claims fell by 36,000 to 280,000 last week - the lowest level since July. US housing starts fell 14.4% in August after an outsized 22.9% gain in July. US building permits fell by 5.6% in August after rising by 8.6% in July. On a more positive note, housing starts in the South (where about half of all US housing construction takes place) rose to an eight month high, while permits in the region rose to their highest level since April 2008.

Vittorio Hernandez

Sep 19, 2014

Wifka, a private fraud investigation firm in Germany, was hired to investigate the July 17 downing of Malaysia Airlines Flight MH 17, which killed 298 passengers and crew on board the ill-fated plane.

Vittorio Hernandez

Sep 19, 2014

In 2000, Softbank of Japan invested $20 million in Alibaba.com, which was not known yet in the global tech circle. Masayoshi Son, the chief executive of Softbank, is reaping the fruit of his investment decision as shareprices of Alibaba (NYSE: BABA) surge ahead of its initial public offering on Friday, Sept 19.

Vittorio Hernandez

Sep 19, 2014

A new startup in the US is offering handsome male servants who would pamper their employers in the tradition of butlers for $125 per hour. The firm, aptly named ManServants, was established by two young female entrepreneurs. Some of their man servants are former strippers.

Vittorio Hernandez

Sep 19, 2014

At the end of a day which saw a stronger start the Aussie market has recovered after its lunchtime slump, closing slightly higher and thus ending a six day losing streak. The All Ordinaries Index (XAO) closed at 5419 points up 0.14%.

Vittorio Hernandez

Sep 18, 2014

A former NHS nurse has become the first volunteer from the U.K. to undertake the Ebola vaccine trial on humans.

Esther Tanquintic-Misa

Sep 18, 2014

Despite a firmer start this morning, the Australian sharemarket is trading at its lowest level since 2 July at lunch. The All Ordinaries Index (XAO) is below the key 5400pt mark, is down for the seventh day and this is the worst week for local markets in 15 months. Volume iselevated partly due to index option expiry today which tends to result in a volume spike.

Vittorio Hernandez

Sep 18, 2014

Chinese e-commerce giant Alibaba Group Holding (NYSE: BABA) increased the price range of its initial public offering scheduled to launch on Friday, Sept 19. The new price range of $66 to $68 from the previous $60 to $66 is an indicator of the strong demand for shares of the e-commerce portal founded by former teacher Jack Ma.

Vittorio Hernandez

Sep 18, 2014

Rare enterovirus D-68 (EV-D68) has reportedly entered Canadian shores.

Esther Tanquintic-Misa

Sep 18, 2014

The FOMC statement retained 'considerable time' and changes to the economic statement were limited; however, the Summary of Economic Projections were all slightly higher than expected, which triggered a mass wave of USD buying.

Vittorio Hernandez

Sep 18, 2014

Rise in sea levels could cost the Australian economy hundreds of billions of dollars. The Climate Council has released a report revealing the costs of infrastructure if no action is done to prevent future damages.

Reissa Su

Sep 18, 2014

The US Federal Reserve left interest rate settings unchanged with the federal funds target range at zero to 0.25% and decided to wind back asset purchases from $25 billion to $15 billion a month. The Fed retained its key statement "that it likely will be appropriate to maintain the current target range for the federal funds rate for a considerable time after the asset purchase program".

Vittorio Hernandez

Sep 18, 2014

The financial intelligence agency AUSTRAC ordered on Wednesday the temporary suspension of the operations of the Bisotel Rieh remittance company on suspicions that it is being used to fund terrorism in the Middle East.

Vittorio Hernandez

Sep 18, 2014

Buyers made several attempts at pushing local shares higher in early trade on Wednesday, although their efforts were brought to heel quickly. As lunchtime loomed on the east coast the market was again dipping into the red. The softer tone local came despite US share markets posting solid gains overnight with a growing sense that the US Federal Reserve will remain cautious about the process of increasing interest rates and any potential rise in 2015.

Vittorio Hernandez

Sep 17, 2014

Pizza Hut Mount Waverley branch offered a free small animal if customers bought 10 large pizzas.

Anne Lu

Sep 17, 2014

The UN needs U.S.$1 billion to contain the rampaging Ebola outbreak. Death toll has now reached 2,461.

Esther Tanquintic-Misa

Sep 17, 2014

B.C. public school teachers to vote on Thursday whether to ratify new deal or not.

Esther Tanquintic-Misa

Sep 17, 2014

Buyers made several attempts at pushing local shares higher in early trade on Wednesday, although their efforts were brought to heel quickly. As lunchtime loomed on the east coast the market was again dipping into the red. The softer tone local came despite US share markets postingsolid gains overnight with a growing sense that the US Federal Reserve will remain cautious about the process of increasing interest rates and any potential rise in 2015.

Vittorio Hernandez

Sep 17, 2014

Air France enters its second day strike by the pilots this Wednesday. Only 40% of scheduled flights will be operated.

Esther Tanquintic-Misa

Sep 17, 2014

Pope Francis could be an easy risk for the ISIS this weekend on his visit to Albania.

Esther Tanquintic-Misa

Sep 17, 2014

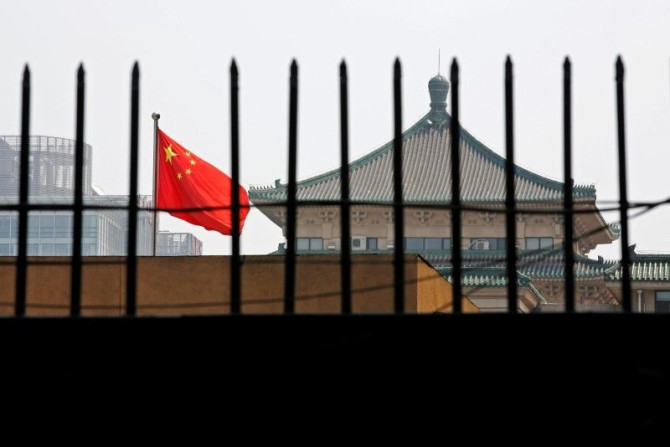

We have never had a clearer example of the adage the 'market is always right' than what happened with China overnight.

Vittorio Hernandez

Sep 17, 2014

In US economic data, producer prices were unchanged in August. Excluding food and energy, prices were up 0.1%. Producer prices are up 1.8% on a year ago. Chain store sales were up 3.6% on a year ago, down from the 4.9% annual gain in the previous week.

Vittorio Hernandez

Sep 17, 2014

Venezuela once had a toilet paper shortage, which appears to have been addressed already. The shortage has shifted to other products, now to branded breast implants that the nation's female population obsessed with physical appearance, are now using made-in-China implants or even those that are of the wrong size.

Vittorio Hernandez

Sep 17, 2014

The local market extended its losses in the second half of trade, with the All Ordinaries Index (XAO) down 0.5 per cent or 29.2pts to 5446.2. The miners ended modestly firmer; however the improvements lessened this afternoon while falls from the big banks held the market back most. Australian shares have fallen for five consecutive sessions while yesterday was the worst day in five weeks for local stocks.

Vittorio Hernandez

Sep 16, 2014