Dell gobbles-up EMC in largest tech deal in US history; debt problem looms

The biggest ever U.S. tech deal has been compared to a minnow swallowing a shark, but Dell's stunning acquisition of leading corporate storage provider EMC has made the minnow one of the top three firms in the enterprise technology industry.

Funded by debt, personal computer maker Dell, Inc. acquired EMC Corporation for $67 billion in cash and stock. Dell partnered with MSD Partners and private-equity firm Silver Lake on Monday to complete the acquisition.

The mega deal makes Dell the No. 3 player in the enterprise technology industry by revenue behind Hewlett-Packard and IBM. Its takeover of EMC will complete Dell’s transition from a consumer oriented firm known mainly for its ubiquitous desktop PCs to one providing storage solutions and technology for large companies.

The deal is surprising since EMC has a market cap of $54.3 billion while Dell’s is half that: $25 billion. This disparity in resources has led analysts to compare the acquisition to a minnow swallowing shark or a guppy eating a whale, among other colorful comparisons.

Dell was the third largest PC vendor in the world in 2014 after Lenovo and HP. It’s currently the top maker of PC monitors in the world.

But there are concerns the debt-fueled takeover could spell trouble for Dell in the long-run. Dell is currently over $11.7 billion in debt without including debt from the EMC deal, said FactSet Research Systems, an American multinational financial data and software company, according to the Wall Street Journal. Dell CEO Michael Dell, however, said both firms expect to pay down the debt over the next two 24 months.

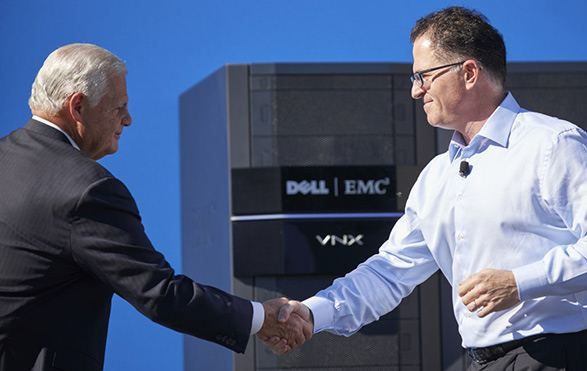

Dell will lead the combined company as chairman and CEO. EMC CEO Joe Tucci is due to retire soon.

The merger of Dell and EMC will create the industry leader in the $2 trillion information technology markets, claimed Dell during a conference call.

“This transaction also strengthens both companies in the increasingly competitive global marketplace”, said Dell.

Tucci said the mega-deal makes strategic sense because the tech industry is undergoing "a tremendous transformation ... where traditional information technology "is being incredibly disrupted”, according to USA Today.

“The transaction combines two of the world’s greatest technology franchises -- with leadership positions in servers, storage, virtualization and PCs -- and brings together strong capabilities in the fastest growing areas of our industry, including digital transformation, software defined data center, hybrid cloud, converged infrastructure, mobile and security”, said EMC in a press note.

EMC and Dell said they had no immediate plans to lay off employees but this remains a looming possibility. EMC was No. 2 on Fortune’s list of the World’s Most Admired Computer Companies in 2015 for the fifth consecutive year.

Contact writer at feedback@ibtimes.com.au, or let us know what you think below.