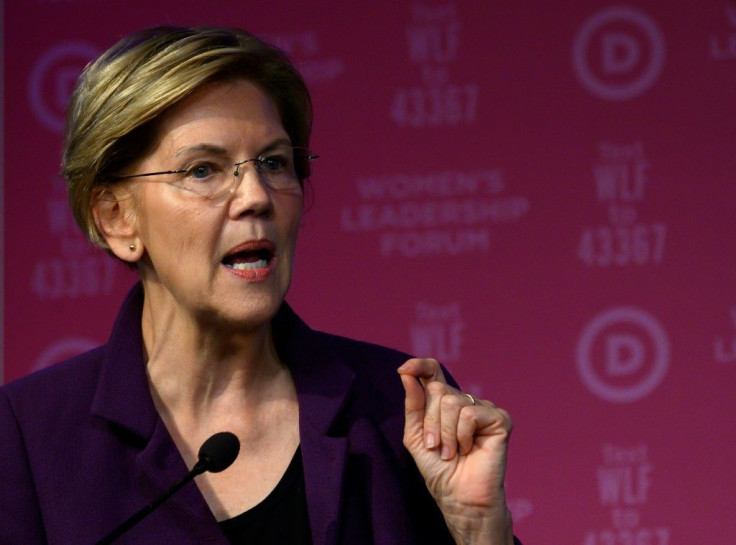

Elizabeth Warren Asks SEC To Regulate Cryptocurrency

Sen. Elizabeth Warren, D-Mass., issued a warning about the “highly opaque and volatile” risks of investing in cryptocurrency and called its lack of regulation "unsustainable."

Warren, who chairs the Senate Banking Committee’s Subcommittee on Economic Policy, sent a letter Wednesday to Securities and Exchange Commission Chair Gary Gensler to lay groundwork for legislation to regulate the popular and growing financial market.

Warren asked Gensler several questions in the letter and said she needed answers by July 28.

"Do you believe that cryptocurrency exchanges are currently operating in a 'fair, orderly, and efficient' manner? If not, what problems has the SEC identified that are associated with the use of these exchanges?" she asked.

Warren is a long-time critic of bitcoin. In a CNBC interview in March, she described the popular cryptocurrency as "speculative in nature and going to end badly."

She noted the precarious nature of digital currency.

"While demand for cryptocurrencies and the use of cryptocurrency exchanges have skyrocketed, the lack of common-sense regulations has left ordinary investors at the mercy of manipulators and fraudsters," Warren said.

"These regulator gaps endanger consumers and investors and undermine the safety of the financial markets. The SEC must use its full authority to address these risks, and congress must also step in to close these regulatory gaps."

Warren said cryptocurrency platforms lack basic protections noting that nearly 7,000 people reported a combined $80 million in cryptocurrency scams, warning the lack of regulation to provide protection for investors is not sustainable.

Warren cited comments from Commodity Futures Trading Commission Commissioner Dan M. Berkovitz.

"In a pure ‘peer-to-peer’ DeFi system… [t]here is no intermediary to monitor markets for fraud and manipulation, prevent money laundering, safeguard deposited funds, ensure counterparty performance, or make customers whole when processes fail. A system without intermediaries is a Hobbesian marketplace with each person looking out for themselves. Caveat emptor—‘let the buyer beware,'" Berkovitz said.

Cryptocurrencies reached a record of capitalization of $2 trillion in April and Visa recently announced more than $1 billion in cryptocurrency was spent within the first six months of 2021.

Among other experts, fintech editor James Ledbetter has described bitcoin as "a highly volatile, highly risky investment.”

Treasury Secretary Janet Yellen has said cryptocurrencies pose risks to financial stability and thinks greater regulation is necessary to protect consumers.