New Zealand Bitcoin ATM Shuts Down Due to Lack of Bank Support, Refusal of Facilities

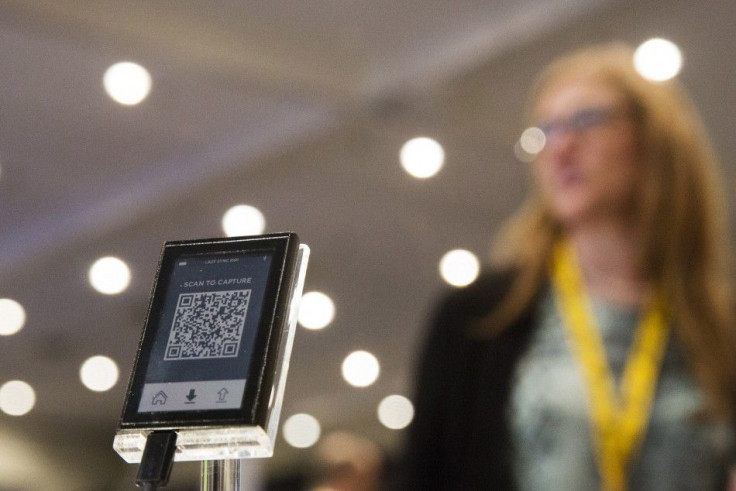

New Zealand ATM operator BItcoin Central has announced it will close its facilities and sell its equipment within the week. According to reports, the banks in New Zealand refused to provide the necessary facilities even though Bitcoin Central has completed the legal requirements.

The closure of the Bitcoin ATM is considered a setback to the digital currency industry in New Zealand where it enjoyed uninterrupted growth and success in the previous months.

On its Web site, Bitcoin Central said without the support of banking facilities, the Bitcoin ATM business cannot survive on a long-term basis. The company cited the "negativity" from the banking sector has become a threat to other businesses. Bitcoin Central deemed it best to shut down ATM services for the cryptocurrency.

Before the Bitcoin operator's announcement, the acceptance of Bitcoin in New Zealand is an example of the digital currency's potential in the mainstream market.

The opening of Bitmart, an online supermarket that features Bitcoin and Dogecoin as payment earlier in the year, yielded huge orders, according to reports.

Bitto NZ, New Zealand's first Bitcoin ATM provider, is prepared to present the country's first cryptocurrency conference dubbed as "Bitcoin South" later in 2014. The Bitcoin conference seeks to report the latest developments involving the digital currency.

Previously, the Reserve Bank of New Zealand (RBNZ) deputy governor and operations head, Geoff Bascand, said digital currencies may one day replace cash. In his recent speech before the Royal Numismatic Society in Wellington, he described digital currencies like Bitcoin as a challenge to the form and use of money.

He believes Bitcoin is a "very low cost payment method with strong security features." Bascand said this feature makes it better than traditional payment modes.

However, he also noted digital currencies still have several drawbacks since few businesses accept them as a form of payment. According to reports, price volatility remains a concern. Bascand explained that if certain conditions are met, digital currencies can replace money.

In late 2013, both the Reserve Bank of Australia and the Reserve Bank of New Zealand had issued warnings about digital currencies. Regulators have taken steps to control Bitcoin development in both countries.