Porn producers are complaining that companies are keeping away from them, noting the change in tolerance for the X-rated industry especially after several HIV scares as some actors tested positive for the disease.

The Australian market closed the first day of the trading week on a high, with the All Ordinaries opened up 16pts higher at the beginning of the session and by the close the markets had added 21.2pts and the ASX 200 up 24.6pts to 5,511.4pts.

It is a sad day for the mainstream radio industry in Australia on Monday, July 14, as Radio Australia anticipates major job cuts. However, this fact-of-life among employees of being axed during hard times could be an opportunity for broadcasters to try new platforms to continue with their careers.

Charges of sexual harassment have been slapped against a top female executive of Yahoo! in California by one of her former female employees.

Japanese Prime Minister Shinzo Abe capped his three-day visit to Australia by signing a free trade agreement (FTA) with Australia, which opens Japan's $5 trillion market to the Land Down Under.

The Australian market started the week's trade in positive territory after the US and European markets closed higher on Friday.

The All Ordinaries opened up 16pts higher at the beginning of the session and by lunchtime the markets had added 28.6pts to 5,503pts.

The final phase of an operation to salvage Italy's ill-fated cruise ship Costa Concordia has began on Monday, two and a half years after it sank off the island of Giglio, claiming 32 lives in the process.

Now it can be told. Seems German Pope Emeritus Benedict XVI's prayers worked better than Argentinean Pope Francis. And sourgraping Brazil is very much elated that archrival Argentina didn't win the coveted World Cup 2014 title.

Financial stress in Europe has seen the US market log its worst week in four months.

In US economic data the Federal Budget was in surplus by US$71 billion in June, below forecasts of an US$80 billion surplus. The weekly Economic Cycle Research Institute Leading index was up 4.4% on a year ago, up from 4.3% in the previous week.

After an erratic night of trading in Europe and the US the Aussie market started weaker but within the first 2 hours of trade managed to rally out of the red.

Because of the uncertainty surrounding Singapore's property sector, over 68,000 new Central Depository Accounts were opened in 2013. It is the largest number of new retail investors in the prosperous Southeast Asian nation in the past five years.

French police on Thursday said it had intercepted a terrorists' plot to blow-up the famous romantic monument Eiffel Tower, the Louvre as well as a nuclear plant in France last summer.

Despite a softer start to trade this morning, the Australian sharemarket has steadily improved in the lead-up to lunch. The All Ordinaries Index (XAO) is up 0.5 per cent, is improving for the second day and has defied the weak lead from Wall Street overnight.

Air New Zealand has received a new plane on Friday, and it's no less than the first ever Boeing Dreamliner 787-9.

Addiction treatment and rehabilitation programs leader BioCorRx Inc. (OTCMKTS: BICX) has announced a series of transactions that strengthens the company's balance sheet and offers future, income-producing upside through the elimination of all convertible debt.

There won't be any fare price reductions even if the carbon tax surcharge gets scrapped, Australian flag carrier Qantas Airways said this week.

If all pilots were as considerate and as caring as Frontier Airlines pilot Gerhard Bradner, flying passengers surely won't mind flight delays. Armed with 50 boxes of pizza, Bradner diverted what could have been a total PR disaster for the airline company, no thanks to bad weather.

Suppliers of Apple Inc. had a strong June quarter which analysts believe is a positive sign for the company too. According to reports, analysts continue to look ahead for Apple's expected product releases in the fall.

Japan's capital of Tokyo is now on high alert in anticipation of Typhoon Neoguri which is expected to reach areas near the tsunami-crippled Fukushima nuclear power plant on Friday.

Portugal saw one of its largest banks exhibiting signs of financial stress overnight, as Banco Espirito Santo missed a debt repayment.

In US economic data new claims for unemployment insurance (jobless claims) fell by 11,000 to 304,000 in the latest week. Wholesale sales rose by 0.7% in May, in line with forecasts, while inventories rose by 0.5%.

After a solid night in US Aussie market lifted from the open of trade and by the close ended higher. The All ordinaries Index added 12.1points to 5454.3 points with most sectors closing higher.

After a solid rebound in the US overnight - helped by positive commentary from the Federal Reserve the Aussie market has opened higher before falling back at noon. After the Federal Reserve stated in its minutes from the last FOMC meeting, that it plans to end its current stimulus program in October 2014. The Dow Jones up nearly 80pts and the NASDAQ up just under 30pts.

Pope Francis has reshuffled the leadership of scandal-riddled Vatican Bank and has named Jean-Baptiste de Franssu, the former head of Invesco Ltd.'s European business, to lead it.

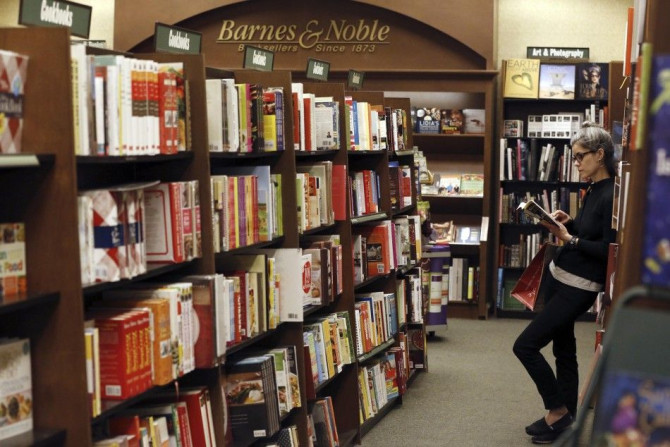

There is no clear investor-education authority insofar as investor education is concerned, a new survey by the CFA Institute showed. Among seven information sources listed in the poll, books, magazines and online media emerged as the top choice, garnering 37 per cent of the responses.

British Web site Daily Mail has issued an apology statement to American Actor George Clooney after he slammed the tabloid for false fiancée story via an op-ed.

The FOMC minutes have provided further reason for the market to grind higher. There was nothing that really broke with the current policy settings, however the discussions from the minutes had some very interesting revelations, with the most interesting of those coming from the 'exit strategy' of the asset purchase program

The US Federal Reserve FOMC minutes from its June 17-18 meeting were released. The Fed began detailing how it plans to ease the US economy out of an era of loose monetary policy. The minutes showed that Fed participants ´´generally agreed´´ that its monthly bond purchases would end in October. There was also discussion about the central banks current policy of reinvesting its $4.2 trillion in asset holdings as the securities mature. Policymakers debated how to reduce those holdings without disru...

Sellers continued to make an impression on the local share market on Wednesday. At the best levels of the day the ASX 200 was down by 10 points; at the lows of the session the index had shed 71 points; at the closing bell the market was down 58 points or a shade over 1%. In broader term the market remains above the 5400 mark at 5452.0. This point is worth keeping in mind. It was only several weeks ago that the market was having a lot of trouble sustaining itself in the area below 5400 for the in...